Plastiq Let’s You Take Advantage of Credit Card Cash Back and Rewards On Every Kind of Payment

Whether it’s boosting your credit rating, financing purchases, improving cash flow, getting access to more financing with better terms, or earning rewards and cashback, you know I’m a huge fan of leveraging credit cards to grow your business. There are a ton of advantages of putting virtually all your purchases on plastic. But what if your biggest supplier doesn’t take credit cards?

You’re literally missing out on tens of thousands, if not hundreds of thousands or even millions of dollars, of business building cashback and other rewards.

Until now, if you had vendors who didn’t take credit cards, you just had to accept that sad fact and try to maximize your purchases with suppliers who do accept credit cards.

What changed?

A service called Plastiq came into the picture. (PLASTIQ/FUNNELDASH LANDING PAGE URL TK) is a service that lets you use your credit or debit cards to pay vendors that don't typically accept those kinds of payment methods. This means you can:

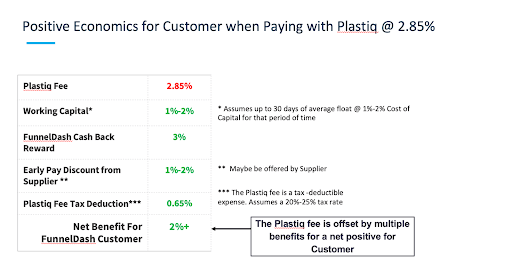

In exchange, Plastiq charges you a one-time processing fee of 2.85% for credit cards. And naturally, if you don’t pay those credit card bills off each month, you'll incur interest at whatever rate your card charges.

This is a great way to ease cash flow issues while revenue comes in from ads you’re running. And even with the processing fee, it’s going to be cheaper than a high-interest option like a cash advance or loan. Plus if you pay the credit card bill off quickly and are earning cash back, travel rewards, or other lucrative benefits, that can offset the processing fee.

Here’s How Plastiq Helped 10,000 Athletic Clothing Capitalize on Their Launch.

Just to give you an idea of how Plastiq made a difference for a real-world company, here’s a case study they recently shared with me.

How Does Using Plastiq to Pay Vendors Work?

Let’s get into the nitty-gritty of this thing. Plastiq lets you pay one-time or recurring payments like inventory, advertising and marketing, freight, rent, utilities, and a variety of other expenses, including international vendors. To use it, you simply add your credit card to your Plastiq account and use it to pay bills and invoices. Plastiq then pays your vendor on your behalf using a payment method that the vendor accepts. These include ACH, wire transfer, or a paper check. Checks read to the vendor as coming from you, not from Plastiq. The supplier doesn’t need a Plastiq account to accept payments.

What Kinds of Companies Use Plastiq?

Not surprisingly, E-commerce businesses are some of the top users of Plastiq. And it’s easy to see why.

E-commerce companies have a lot of expenses that rank in the top spending categories for Plastiq, including:

Other companies in a variety of industries have also found using Plastiq in conjunction with their business credit cards to be a smart strategy including those in technology, professional services, construction, wholesale/distribution, and others.

What Kind of Credit Cards Does Plastiq Work With?

The Plastiq bill pay service is compatible with a wide range of credit cards, including:

But be aware that some credit cards have restrictions on the types of bills you can pay through Plastiq. You can see a list of Plastiq's exceptions here.

How Quickly Do Vendors Get Paid?

The speed varies based on the method of payment you choose. If you have bank account information for the supplier payment can be as quick as same-day via Wire or 2-3 business days via ACH. If you don’t have bank account information, Plastiq will send a check that arrives within 5-8 business days. Regardless of the method used to pay your suppliers, they will receive a notification that you have paid on the day you make the payment.

Here are the specifics:

Wire Your supplier will get paid the same day if the payment is made before 2:30 pm PT. They’ll get it the next business day if your payment is made after 2:30 pm PT.

ACH Your supplier will get the payment in 2-3 business days with the option for guaranteed 2 business days

Check Your supplier will receive the check within 5-8 business days so make sure to submit it in enough time so you won’t be charged a late payment.

How Does Plastiq Work with AdCard?

Not surprisingly, this is what I wanted to know when I talked to the folks at Plastiq. The good news is that it works quite well. That’s a very good thing because advertisers use AdCard to buy millions of dollars worth of ads. Not getting the 3% (or potentially up to 7.5%) cashback that you get with AdCard is a BIG missed opportunity.

There is no credit qualification process to pay with Plastiq. They use your existing AdCard to make payments to suppliers.

Here’s How to Start Using Credit Cards to Pay Vendors Who Don’t Take Credit Cards

It’s really pretty easy. All you have to do is create a free account with Plastiq and fill in your credit card information. You can add multiple cards and select one as your default.

You'll also need to input information about the suppliers you want to pay via Plastiq, including their name and country. This information will be saved in your account for future use.

To send a payment, select the recipient, the amount owed, the recipient’s preferred payment method (ACH, wire transfer or check). Then enter a date for the funds to arrive. You can include specific details about the bill you're paying - such as invoice number or account number - if your vendor prefers that you include it on your payments. You can put additional details in the "memo" section.

You can make a one-time payment or if it’s something like a subscription you can have them repeat automatically. For suppliers that only accept paper checks via the USPS mail, you may have to submit the payment earlier than usual since they usually take eight days to arrive.

Plastiq gives you a breakdown of the fees in both dollars and a percentage rate on the payment review screen before you complete your transaction. . Once you give Plastiq the okay to send the payment, you’ll receive multiple email confirmations from the company. These include a confirmation of the initial transaction, a notice when a check is physically mailed to the vendor for the payment as well as a notification when the supplier cashes it. And don’t worry, if for some reason your payment cannot be processed, Plastiq will notify you about that too.

It’s a pretty seamless process. There’s no need to inform your suppliers about your using Plastiq. All you need to do is tell the service who and how much to pay. Your suppliers will get a payment notice the day payment is made so they’ll know you’ve paid. And they’ll receive the money in their preferred form of payment.

AdCard + Plastiq Makes Earning 3% Cashback Easier Than Ever

At FunnelDash, we’re really excited about this new partnership between AdCard and Plastiq. If you’re already an AdCard cardholder and you have suppliers that won’t accept payment by credit cards, connect with Plastiq today at (www.plastiq.com/funneldash TK) and start getting the cashback you’ve been missing out on. If you’re not an AdCard cardholder (yet) apply today -- it takes about 5 minutes. Then connect with Plastiq and exponentially expand your cashback earning opportunities.

The average small business has 5 credit cards with a balance of about $32k that they have to keep track of. There’s a better way than rotating through dozens of low-limit credit cards to get the funding you need to scale when you can get it all with AdCard — the best card for Facebook ads with the high limits and more you need to grow your business.

Exclusive Cardholder Benefits