The downside of using Amex, Divvy, Ramp, and Brex credit cards for Facebook ad spend isn’t pretty.

There is no end to the number of financial gurus who will recommend the best credit cards buying digital advertising, but there is virtually no one who will tell you which credit cards to avoid for Facebook ad spend.

Why? It’s simple. These guys are financial gurus not marketing experts who know little to nothing about buying Facebook and other digital advertising.

If you’re spending north of $10K a month on ads, you need credit card recommendations from financial/marketing experts who completely understand your pain points. And can tell you which cards will (and won’t) ease them.

As the creator of the first credit card built specifically for advertisers, I’m going to give you the lowdown on what you need to know, So let’s dig in on which old school and new credit cards to avoid for Facebook ad spend. And I’ll do it using criteria that are hyper-relevant to you as an advertiser.

Don’t be blinded by old standbys and bright new shiny ad spend financing options.

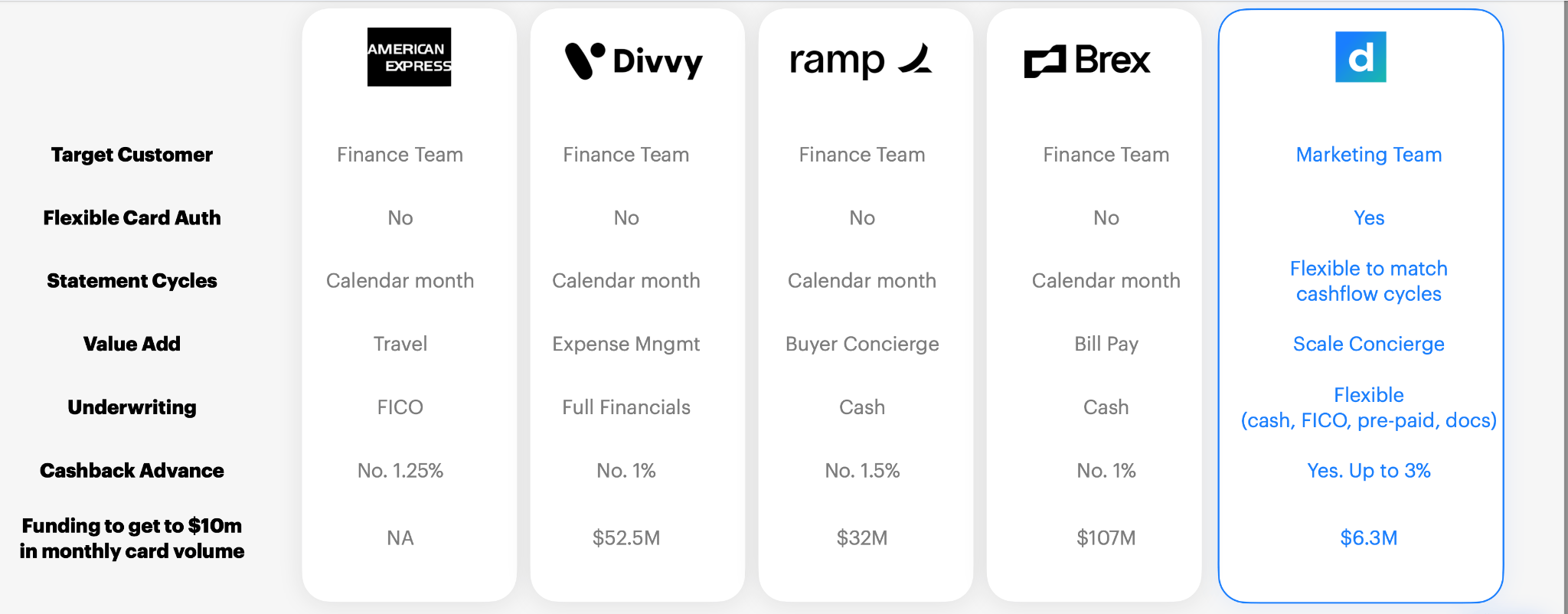

In addition to Amex, the granddaddy of rewards credit cards, a number of new players have stepped onto the Facebook/digital advertising financing stage. Here’s a quick snapshot of who they are. What they offer. And how they compare to AdCard (now dash.fi).

Most credit card companies aren’t talking to you.

They are talking to your financial department. They’re interested in credit scores. Capping credit limits. And ladling on requirements and reviews that can kneecap your ability to scale as fast as you need to.

As someone who’s in the business of buying Facebook ads to scale your or your client’s business, you are concerned about other things like that are way out of their wheelhouse. Why deal with credit card companies like Amex, Divvy, Ramp, and Brex that don’t speak your language? Especially when there’s one that speaks fluent marketing.

Rigid one-size-fits-all financial products don’t meet your real-time Facebook ad buying needs.

Few fields are more fast-paced than digital ad buying. Results can start trending up or down in a matter of minutes. So the ability to step on the gas by significantly upping your ad spend immediately is essential.

Unfortunately, most credit card companies don’t understand that. Their Inflexible, outdated underwriting and authorization policies more often than not decline on the fly credit increases. And that can potentially tank the success of a campaign that is really taking off.

As an advertiser, you need a lot more flexibility. You need a credit card that doesn’t impose low spending caps or has card failures. You need one that allows you to easily access as much credit as you need when you need it.

You need a card that offers proprietary card authorization that stabilizes spend across channels and accounts. Amex, Divvy, Ramp, and Brex don’t give you that.

Monthly billing cycles are out of sync with your Facebook ad-buying business.

Wouldn’t it be nice if all of your revenue and expenses came in and went out on a regular monthly schedule? That’s a dream that’s never going to come true. But cards like Amex, Divvy, Ramp, and Brex who have monthly billing cycles act like that dream is a reality.

That’s what a credit card that’s focused on financials does. A card built for advertisers understands that you’re going to spend a ton on ads and bring in a bunch of revenue in Q4, and then slow way down in Q1. So it

offers customized revolving statement cycles to match your brand’s payback periods on ad spend. Plus smart auto-pay to keep your card active. Things that all minimize the hours your finance team has to spend keeping up with.Choose a third-party processor if: | Choose a merchant account if: |

You’re a small business that has 50 or fewer employees | You’re a bigger company with more than 50 employees |

You don’t do many transactions | You want more control |

You value simplicity | You want all transactions to occur within your platform |

You have bad or no credit | You want low transaction fees |

Who needs value-add benefits that don’t really benefit your Facebook ad buying business?

At this point, most savvy advertisers understand that earning rewards points for travel isn’t as attractive as it once was. Expense management is a good thing. But if it’s pretty much the only thing, you can probably do better elsewhere. As for buyer concierge services and bill pay? Nice to have but those are fringe benefits that don’t move the ball forward when it comes to growing your business,

Now having a team dedicated to helping you scale your business? That’s a real value that Amex, Ramp, Divvy, and Brex don’t offer.

What good is a business credit card if you can’t qualify for it?

Cards like Amex look at FICO scores. Divvy demands an open burqua of full financials. While Ramp and Brex are all about your stash of cash. Those are underwriting requirements that can shoot down an approval for many businesses that are just getting started or getting back on their feet.

A card whose underwriting is based on ad performance and campaign payment history opens up significant financing opportunities for Facebook ad buying companies that might not otherwise be approved.

These more flexible requirements that may not even include your credit score takes the worry out of whether or not you’ll qualify for it. And who needs another worry?

What’s better - a card that pays you cashback upfront or one makes you wait…and wait…and wait.

Not a trick question. Getting up to 3% cashback upfront before you buy a single ad is way better than waiting to get 1% to 1.5% cashback (that may be capped) afterward. That means you can securitize future recurring ad spend into upfront cashback for growth today

So if you’ve been using Amex or have been tempted to sign up for Divvy, Ramp, or Brex to buy Facebook or other digital advertising. Resist the urge and sign up for a marketer-designed card that was specifically designed to help you scale your business.

Discover how to get up to 3% cashback – and more – with the world’s first card made for advertisers.