A twist on the old saying goes, “You’ve got to HAVE money to make money”.

That’s especially true when it comes to growing your SaaS business.

If you’re a “Poor Advertiser”, you’re going to be digging deep into your own pockets.

If you’re a “Rich Advertiser” and know that the secret to 7-figure success is spending other people’s money to make money, you’re going to be looking for a way to get it.

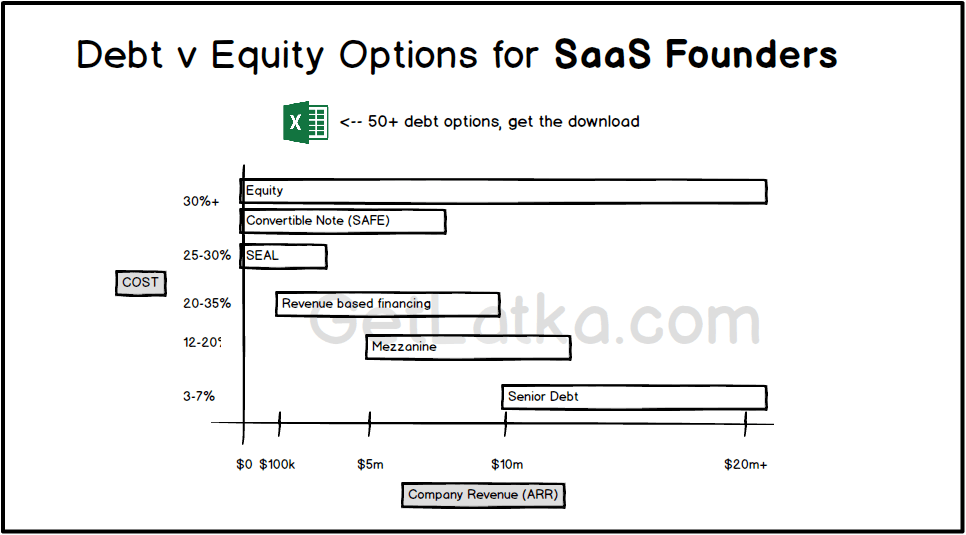

Sure, getting a loan from somebody like SaaS Capital or Silicon Valley Bank is a great option to make a capital investment for the costs of development.

They’ll let you borrow 2X to 4X your monthly recurring revenue (MRR) that you can pay off over 3 to 5 years.

The catch is, in order to get that money, you’ve got to have money in the form of MRR – and lots of it. Most venture debt lenders won’t even consider you for a loan if you’re not raking in at least $250,000 a month in MRR. Is that where you’re at?

Not quite yet? Not even close?

So, how do you get there? It’s no secret that the answer to building your MRR to the point that a lender will consider backing you with serious capital funding is to promote your product to as many potential subscribers as humanly possible.

It’s no secret that the answer to building your MRR to the point that a lender will consider backing you with serious capital funding is to promote your product to as many potential subscribers as humanly possible.

And that’s getting increasingly harder to do.

The era of using unpaid social media to build your business is over. Organic reach is in the toilet. And the battle between the more than 150,000 individual SaaS offerings that Cisco says were competing for search rankings and audience eyeballs two years ago is heating up to the point where trying to even half way win it is more trouble than it’s worth.

So, how do you reach that magic MRR threshold?

Two words: Paid Advertising. The latest Private SaaS Company Survey indicated that the more your company spends on ads the faster it will grow. So, you know you’ve got to spend more to make more. But where are you going to get the money to pay for it?

If your ads are ROI positive, you might be asking “why can’t I just fund my ad spend with the money those ads are throwing off?”

The answer is simple -- and it begins with another question.

When you have a machine that kicks out 3 dollars for every 1 dollar you put in everybody gets all excited. But nobody ever asks, “How long did you have to wait to get that 3 dollars out – and what kept you going during that time?”

Spending the money you have coming in on ads could very easily drive a very big stake into the heart of your cash flow. If you pour a ton of money into ad spend in 3 to 6 months you’re going to be cash strapped and are going need to max out your credit cards get some other kind of funding just to keep the lights on.

That’s what a Poor Advertiser does.

The truth is, when you have a machine that kicks out 3 dollars for every 1 dollar you put in everybody gets all excited. But nobody ever asks, “How long did you have to wait to get that 3 dollars out – and what kept you going during that time?”

What the Rich Advertiser knows is that in order to be successful you need to maximize your float -- the time between when you spend other people’s money to buy ads and the time when you have to pay it back.

Yeah, I know, getting access to other people’s money (financing) can be scary and complicated, but if you do it the smart way, it is the best and fastest way to get you where you want to go. (More about that later.)

Think of getting access to that money and maximizing your float on your ad spend as taking out a bridge loan -- the kind that you get when you’re building a house. A bank won’t give you a big chunk of low interest mortgage money until the house is finished. But you need funds now to build it. Same goes for your SaaS company. In order to grow your business built big enough to qualify for a MRR loan you’re going to need funding now to spend on paid advertising.

Now you may be thinking, “Hey, I don’t have to finance my ad spend. My current ads are ROI-ing enough to cover the cost of buying them.”

Except that they probably aren’t. And here’s why…

Your Payback Period is going to last longer than the money you need to keep your company afloat.

In case you’re not familiar with the term, the Payback Period, or the time it takes to turn a profit, is how long it takes for your company to recover the total cost of acquiring one customer. Notice how I said total – because that cost includes operating expenses, salaries, ad development etc. beyond what you spend to buy the ads.

So, say you your customer acquisition cost (CAC) is $350. Your customer pays $25 a month for their subscription or $300 a year. Your payback period for that customer is 13.9 months. After that time, and only after that time, are you making a profit on that customer.

- Trial Funnel – If you are selling a lower priced subscription SaaS product chances are you are using a 30 or 60-day credit card/no-credit card free trial period to sell it. So, at the absolute minimum, you’re going to START your CAC Payback Period between one month and three months from the time the customer signs up.

- Demo Funnel – Higher ticket products that require demos to close the sale take even longer to close and start making money. And since unlike a free trial that has a hard start and stop time frame, a demo sale is dependent on the time it takes the customer to make the decision to purchase – or not – which can be anywhere from instantly to several months.

A general rule of thumb is that the average SaaS startup has a CAC Payback Period of around 12 months. Some pre-IPO firms take as long as 24 months. Even very high performing companies have a 5-7 month CAC Payback Period. Still, that’s a long time to have to cover ad spend costs to build your MRR and keep the lights on in your office.

And that’s why SaaS companies get into financial trouble.

Just as an example, I knew a guy who was spending $40k a month on ads and his Payback Period was 6 months. So, he needed $240k in capital to support that level of ad spend. He wanted to grow. But if he wanted to grow by 300% that would mean he’d need $720k – and he wasn’t comfortable with that level of risk.

So, what’s the solution?

You know you need to spend money on ads to scale your MRR to where you need it to be. Because of the lengthy Payback Period, you know your ads aren’t going to pay for themselves – let alone your overhead. Getting access to other people’s money (the smart way) is the only way to go – and you can find out more about what it is by clicking here.