Startup with young man in the night

You've worked hard to get your business up and running, but now it's time for you to grow. You need more equipment, inventory, a bigger office space — none of which come cheap. If you're like many entrepreneurs, business credit cards are among the most popular sources of startup financing. For small businesses struggling to find funding from traditional lenders or other sources, borrowing against a credit card can be an attractive option. But before you make that move, according to AbstractOps.com here are some important things to keep in mind.

Startup-Centric Rewards

One of the most common ways business owners use credit cards is as a simple cashback card for everyday purchases. But when it comes to financing, you need rewards that are tailored specifically towards your startup's needs — things like travel discounts or membership rewards points that can be redeemed for goods and services related to your industry.

Keep your eye out for cards that offer a membership rewards points sign-up bonus, but be aware that many business cards require you to spend a certain amount on eligible purchases within a specific time period in order to qualify to receive them.

Cash Conserving Benefits

As a startup, you're concerned about cash flow, which means if there's a way to avoid paying for something, do it. The best business credit cards for startups are likely to be ones that charge no annual fee. Also, it pays to avoid business credit cards with high APRs and expensive late fees that can sometimes end up costing more than the items you purchased.

Spending Limit that is Based on the Company’s Balance Sheet

For the best credit card for your startup, choose a credit card with set spending limits. A high credit limit may seem like a good idea, but it can also be risky for startups that are only just getting off the ground.

For example, if you have an outstanding balance of $25K and your card charges 18% interest on purchases made with them — then at some point in the future you might end up paying more than twice what you borrowed, to begin with.

This is why many startup founders choose business credit cards with spending limits based on their company's balance sheet or ones that allow them to establish lower limits when they're first starting out.

No Personal Guarantee

Founders shouldn't take on personal liability for their company's debt.

This is because if the business doesn't succeed, all of a founder's assets — including home equity and retirement savings — could be at risk.

So when it comes to credit cards, startups should find one with no personal guarantee requirement as well as an extended repayment period that will allow them enough time to grow their company into profitability without endangering their personal finances.

Cheap and Fast Bookkeeping

Look for a provider with cleanly presented statements, modern online UX, a search feature and that syncs to Quickbooks because the entire point of using a credit card to pay for business expenses is so that you can spend your time on what matters: building and scaling the company.

Spending-Management Tools

As your team grows fast, it will become very challenging to manage your spending if everyone is using their own debit cards and submitting expense reports. That's why you need a spending-management tool.

The best credit cards for startups will be the ones that allow you to easily pay for business expenses to spend more time on what matters: building and scaling the company. Keep these features in mind when searching, like a low-interest rate so that your startup can still grow into profitability with minimal risk of sinking personal finances under high card debt payments; flexible payment options which include online bill paying or paperless statements; no annual fee - because as an early-stage startup, any profit is better than none at all,

Some other useful features include a generous rewards program to help along the way (but don't forget it's not intended as an incentive since such incentives are frowned upon by VCs).

Compare What Each Credit Card Offers and Then Decide

Your business can take advantage of these business-building benefits, including:

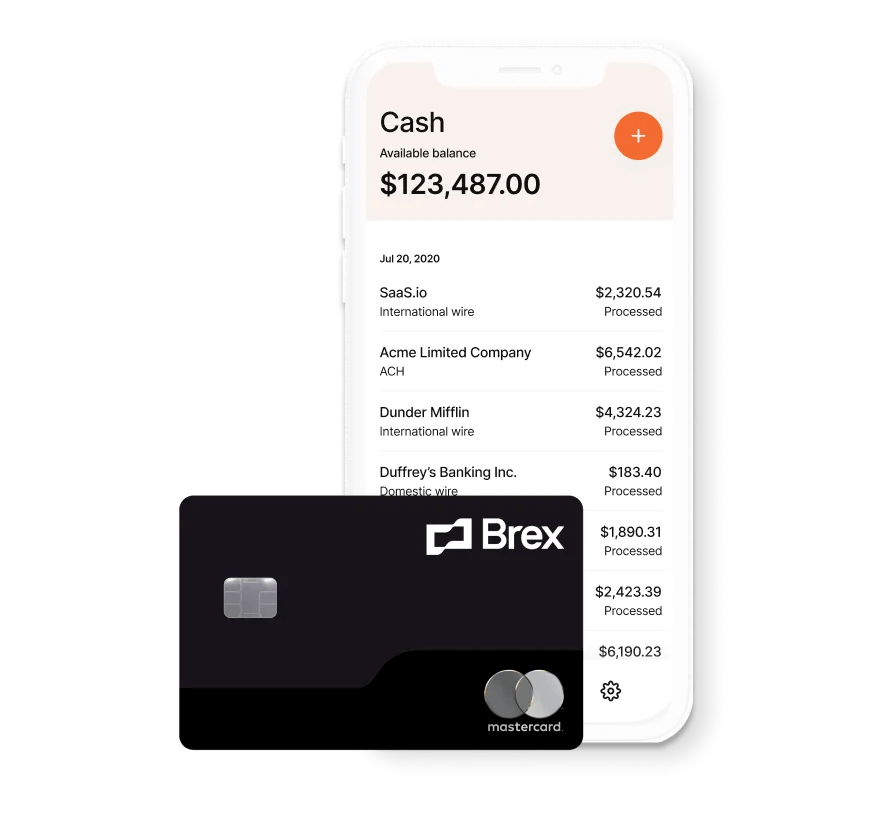

-No Annual Fee. -Free Employee Cards. -0% Interest on Purchases for 12 Months (then 18%). -Special 0% APR financing on qualifying purchases of up to $100,000 with your BREX card from day one. Plus the opportunity to finance larger orders over time.

Card Features and Benefits

Annual Fee:

No Annual Fee

APR:

There is none.

Credit Limit:

10-20x higher limits than traditional corporate cards

Rewards:

Earn 7x rewards on rideshare apps, 4x on Brex Travel, 3x on restaurants, 2x on recurring software. Partner Discounts for Google Ads, Zendesk, Twilio Sendgrid, AWS, and WeWork.

Foreign Transaction Fees:

No

Eligible Companies:

Companies with at least $50,000 in their bank accounts or at least $50,000 in sales each month.

Instant Sign Up:

Yes

Employee Cards:

Up to 5 free employee cards

Virtual Card:

Yes

Branded with Company Logo:

No

Late Fees:

With late fees, but not disclosed.

Startup Centric Rewards:

Yes

High Spending Limit:

Yes

No Personal Guarantee:

Yes

Integration with Accounting Software:

Yes

Spending Management Tools:

Yes

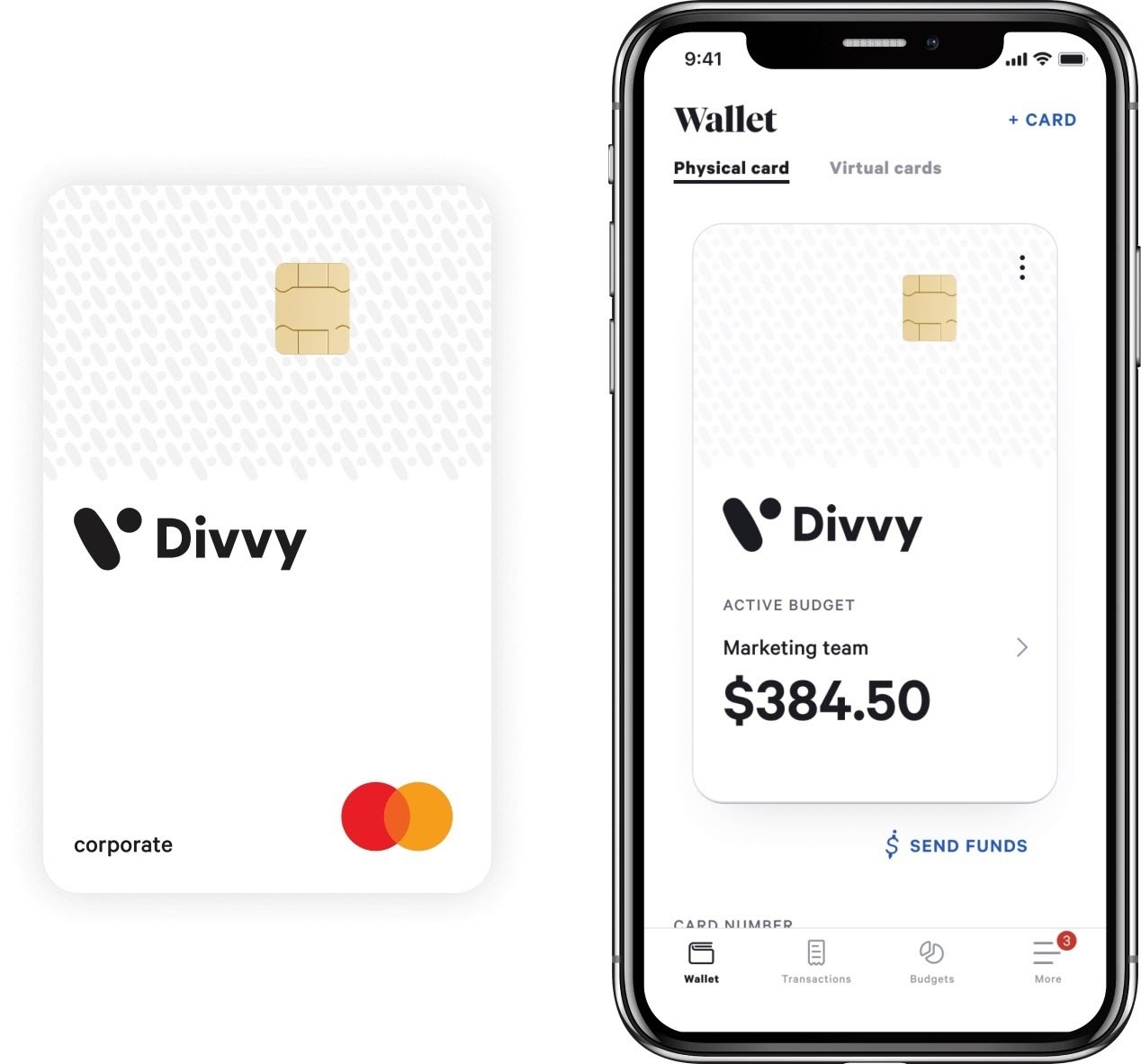

Here are some benefits of the Stripe Corporate Card :

-No annual fee. -Earn up to five points for every dollar spent on everyday purchases like groceries, gas, and utilities which can be redeemed as cashback or statement credits at the end of each billing cycle. Plus earn additional bonus points when you use your Divvy card in combination with merchants that offer discounts through the Deals program such as Groupon, Amazon Local, LivingSocial, and more. And if you're a small business owner who pays their monthly bills online using electronic transfer from your bank account, they'll give you one point per month. -Use our Deal Finder tool to find exclusive deals available only to people with Divvy Visa checking accounts (these offers change regularly).

Card Features and Benefits

Annual Fee:

No Annual Fee

APR:

Unclear

Credit Limit:

Depends on your bank account and payment

Rewards:

Earn 7x rewards on dining, 5x on hotels, and 2x on software subscriptions, although amounts decline if you pay semi-monthly or monthly (vs. weekly)

Foreign Transaction Fees:

N/A

Eligible Companies:

Anyone

Instant Sign Up:

Yes

Employee Cards:

Free employee cards

Virtual Card:

Yes

Branded with Company Logo:

No

Late Fees:

No

Here are some benefits of the Stripe Corporate Card :

-No annual fee -APR starts at an introductory rate of 0% and later moves to 12.99% (variable) -Incorporation Matching: Get up to a $500 credit on your account when you get funded by investors or customers

-No minimum payment due for the first 90 days after opening an account.*

*You will be charged interest from day 91 onwards, so make sure you pay off your balance before that date.

The best part about this card is its flexibility in setup. You can apply for it online and have access instantly with no waiting period. It also has many features that are tailored specifically towards startups such as geolocation triggers which turn geographic borders into boundaries allowing transactions only within that are not offered by other credit cards:

Card Features and Benefits

Annual Fee:

No Annual Fee

APR:

None

Credit Limit:

Based on payment processing and bank history

Rewards:

Earn up to 2% cashback on your top two categories, automatically calculated each month. 1% cashback on other categories. $50,000 in free payment processing after the first $5,000 in spend. Partner Benefits for AWS, Shopify, Notion, DigitalOcean, Zendesk, Intercom, Google Ads, Hubspot, Airtable, and more.

Foreign Transaction Fees:

Free

Eligible Companies:

The company needs to request an invitation

Instant Sign Up:

Yes

Employee Cards:

N/A

Virtual Card:

Yes

Branded with Company Logo:

Yes

Late Fees:

None

Startup Centric Rewards:

Yes

High Spending Limit:

No

No Personal Guarantee:

Yes

Integration with Accounting Software:

Yes

Spending Management Tools:

Yes

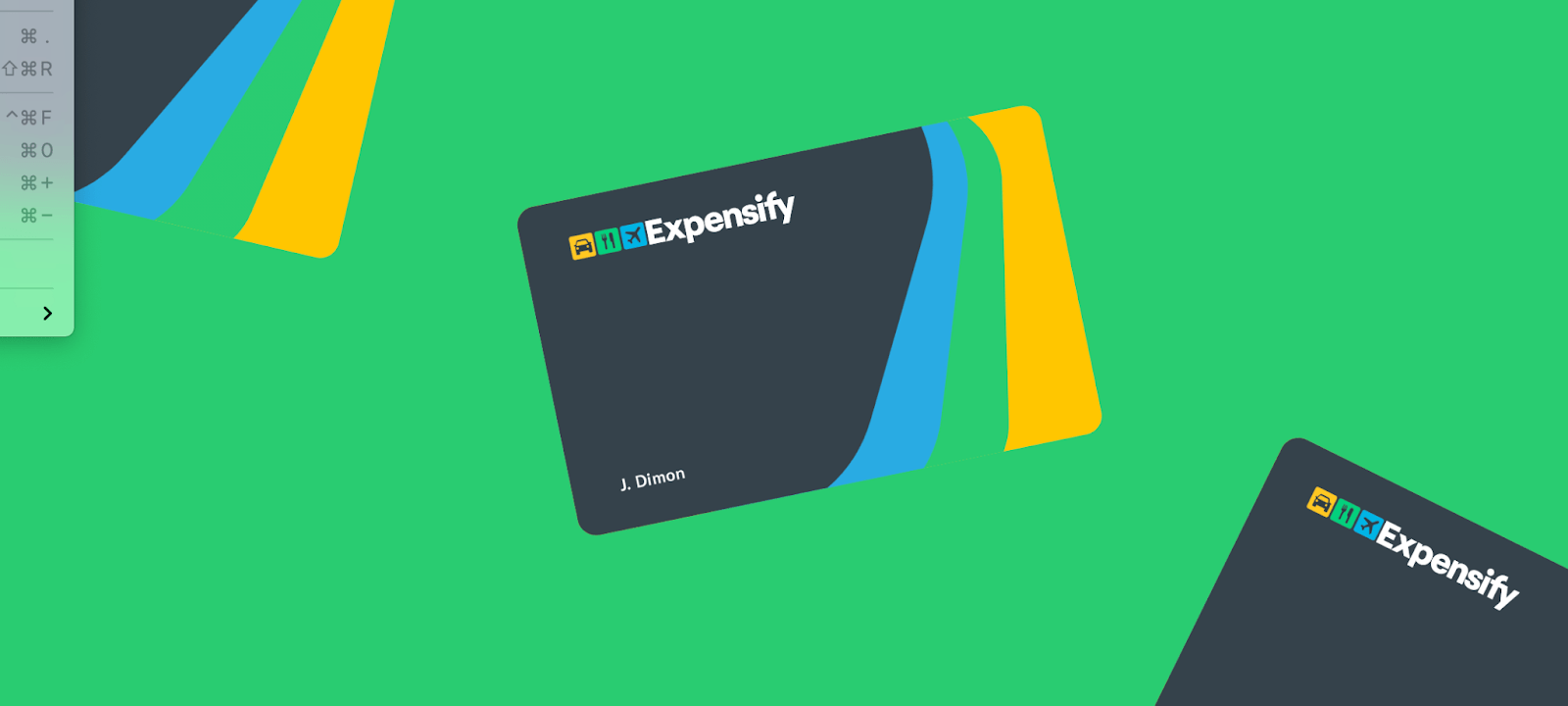

Here are some benefits of the Expensify Card :

No spending limits Earn rewards on purchases and cashback when you pay your bills*

Get reimbursed for travel expenses of up to $250 per year.*

Here is how the card works:

You connect your bank account with Expensify. Whenever a payment from that account comes through, they'll automatically apply it against any eligible expense. It's like having a virtual assistant so you can spend more time working on what matters - growing your business. They'll do all the work (they've even got an app). And because there are no monthly fees or minimums, this means savings in interest charges too. There are also some other benefits like Low-interest rates; Receive alerts about unusual transactions; Mobile.

Card Features and Benefits

Annual Fee:

No Annual Fee

APR:

None

Credit Limit:

Based on bank account balance

Rewards:

Partner benefits for AWS, Highfive, Zendesk, Stackoverflow, Gusto, Stripe, and more. For every swipe, Expensify donates to a relevant cause through Karma Points.

Foreign Transaction Fees:

N/A

Eligible Companies:

*Active user of Expensify

Instant Sign Up:

Yes

Employee Cards:

Free employee cards

Virtual Card:

Yes

Branded with Company Logo:

No

Late Fees:

None

Startup Centric Rewards:

Yes

High Spending Limit:

No

No Personal Guarantee:

Yes

Integration with Accounting Software:

Yes

Spending Management Tools:

Yes

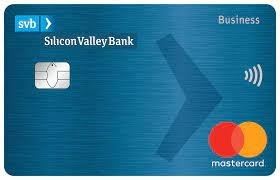

Here are some benefits of the SVB Innovators Card:

Earn rewards on purchases and cashback when you pay your bill. No annual fee, no minimums, or monthly fees. The card is designed specifically with startups in mind so it's perfect for entrepreneurs who need that little extra help to grow their business.

Cashback Rewards: Earn a percentage of your purchase price as cashback each time you use the Card. You will receive an email at the end of every month summarizing the amount earned per transaction type (e-commerce, online transactions). Cash Back Dollars cannot be transferred to another account; they can only be used against future credit card balances associated with this account. Bill Payment Bonus: $25 bonus after paying bills within 60 days of opening an SVB Business Checking Account.

Card Features and Benefits

Annual Fee:

No Annual Fee

APR:

N/A

Credit Limit:

N/A

Rewards:

Earn 2 points for every dollar spent and redeemable towards statement credits, gift cards, travel, and merchandise rewards.

Foreign Transaction Fees:

N/A

Eligible Companies:

N/A

Instant Sign Up:

No

Employee Cards:

Free employee cards

Virtual Card:

No

Branded with Company Logo:

No

Late Fees:

N/A

Startup Centric Rewards:

Yes

High Spending Limit:

No

No Personal Guarantee:

Yes

Integration with Accounting Software:

Yes

Spending Management Tools:

Yes

Here are some benefits of the Capital One Spark Classic for Business card:

-No annual fee

-It's a MasterCard, so you can use it anywhere that accepts MasterCard.

-Earns one point per dollar spent on all purchases (no limit to how many points are earned). Points may be redeemed for cash back or gift cards from major retailers including Macy's and Nike. You also have the option of donating your rewards to charity.

Points never expire as long as the account is open and active* (*some small print about inactive accounts)

The Spark Classic offers no other benefits beyond these great features, but they're enough if you don't want anything else out of your credit card other than earning points. It just offers them in an easy way while saving you money by not charging an annual fee.

Card Features and Benefits

Annual Fee:

No Annual Fee

APR:

Credit Card APR 26.99% variable

Credit Limit:

The minimum credit line is $500 and is based on the ability to pay

Rewards:

Earn unlimited 1% cash back on every purchase for your business, with no minimum to redeem. Comes with travel and emergency assistance services, auto rental damage waiver, and purchase security and extended protection.

Foreign Transaction Fee:

N/A

Eligible Companies:

N/A

Instant Sign Up:

No

Employee Cards:

Free employee cards

Virtual Card:

No

Branded with Company Logo:

No

Late Fees:

29.4% Penalty APR

Startup Centric Rewards:

No

High Spending Limit:

No

No Personal Guarantee:

No

Integration with Accounting Software:

Yes

Spending Management Tools:

Yes

Here are some benefits of the Business Platinum Card from American Express:

-Points: Earn 50,000 Membership Rewards ® points after you spend $5000 in purchases with your new card in the first three months. That's worth up to $750 toward travel when booked through American Express Travel. Use those points for all or part of a flight, hotel stay...just about anything.*

The annual fee is higher than most cards at $595/year (fee waived for the first year). But membership rewards® are valuable because they can be transferred to many airline and hotel partners--so it may pay off in that way if you use them as frequently as possible. The reward point system also has no limit on how many points you earn over time so there is never any pressure to "use 'em or lose ‘em."

Card Features and Benefits

Annual Fee:

$595

APR:

None if you pay the balance in full. The standard credit card APR for Pay Over Time balances is currently 18.24%

Credit Limit:

N/A

Rewards:

Get 5x Membership Rewards® points on flights and prepaid hotels on amextravel.com. Earn 75,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Platinum Card within the first 3 months of Card Membership. $200 Airline Fee Credit. Get 50% More Points on each eligible purchase of $5K or more. Up to 1 million additional points per calendar year.

Foreign Transaction Fees:

Free

Eligible Companies:

N/A

Instant Sign Up:

No

Employee Cards:

Free employee cards

Virtual Card:

No

Branded with Company Logo:

No

Late Fees:

$39 or 2.99% of any past due Pay in Full amount, whichever is greater.

Startup Centric Rewards:

No

High Spending Limit:

No

No Personal Guarantee:

No

Integration with Accounting Software:

Yes

Spending Management Tools:

Yes

Here are some benefits of the Ink Business Unlimited Credit Card from Chase:

- You have the ability to earn 50,000 bonus points after you spend $5000 in purchases within the first three months of account opening. Those points can be worth as much as $500 when used for select business expenses.

- No annual fee. This is perfect if your start-up isn't generating a lot of revenue yet but needs a card that doesn’t charge an annual fee while it starts out.

- Points don't expire so there's no rush to use them right away or feel like you're wasting rewards since they'll always be available and never go bad (unless your credit limit has been exceeded).*

The Ink Business Unlimited Credit Card from Chase also comes with other great benefits such as Purchase Protection.

Card Features and Benefits

Annual Fee:

No Annual Fee

APR:

Pay 0% intro APR for 12 months from account opening on purchases. After that, 13.24%–19.24% variable APR.

Credit Limit:

N/A

Rewards:

Earn $500 bonus cash back after you spend $3,000 on purchases in the first 3 months after account opening. Unlimited 1.5% cashback.

Foreign Transaction Fees:

You'll pay 3% of the amount of each transaction in U.S. dollars.

Eligible Companies:

N/A

Instant Sign Up:

No

Employee Cards:

Free employee cards

Virtual Card:

No

Branded with Company Logo:

No

Late Fees:

$39

Startup Centric Rewards:

No

High Spending Limit:

No

No Personal Guarantee:

No

Integration with Accounting Software:

Yes

Spending Management Tools:

Yes

Ink Business Preferred® Credit Card (Chase)

Here are some benefits of the Ink Business Preferred Credit Card from Chase

- Earn 80,000 points after you spend $5000 in the first three months.

- One point on every dollar spent (it's a flat rate not one of those curve things).

- The card is designed specifically for small businesses and there are some perks such as travel accident insurance that many other cards don't offer. (*)

Ink Business Preferred® Credit Card from Chase has no annual fee* but it does charge an APR at 22% variable*. However, if your credit score is good enough or you qualify with a business history they will give you the lower 15.24% intro APR which lasts 12 months* plus 0% financing for up to 18 months when using their rewards.

Card Features and Benefits

Annual Fee:

$95

APR:

15.99% to 20.99%, based on your creditworthiness.

Credit Limit:

N/A

Rewards:

Earn 100,000 bonus points after you spend $15,000 on eligible purchases in the first 3 months after account opening. Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable, and phone services, and on advertising purchases made with social media sites and search engines each account anniversary year. Points do not expire as long as your account is open.

Foreign Transaction Fees:

Free

Eligible Companies:

N/A

Instant Sign Up:

No

Employee Cards:

Free employee cards

Virtual Card:

No

Branded with Company Logo:

No

Late Fees:

$39

Startup Centric Rewards:

No

High Spending Limit:

No

No Personal Guarantee:

No

Integration with Accounting Software:

Yes

Spending Management Tools:

Yes

Here are some benefits of the American Express Business Gold Card:

-- a generous points program that awards you business rewards, like cash back.

Plus it offers the opportunity to earn Membership Rewards Points on all purchases - not just those made with your card (i.e., at office supply stores or gas stations).

They also offer 0% introductory APR for 12 months* and up to $250 in statement credits annually if qualified*.

The annual fee is $0* which means there are no surprises when you're making payments each month.* Another thing worth noting: There's an EMV chip built into this one so using it abroad will be more seamless! (*)

- One point on every dollar spent (it's a flat rate not one of those curve things).

Card Features and Benefits

Annual Fee:

$295

APR:

Credit Card APR will be a variable rate, 14.24% – 22.24%, based on your creditworthiness

Credit Limit:

N/A

Rewards:

Earn 50,000 Membership Rewards® points after you spend $5,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership. Get more rewards with 4X Membership Rewards® points on 2 select categories where you spend the most each month. Get 25% points back, after you book a flight using Pay with Points

Foreign Transaction Fees:

Free

Eligible Companies:

N/A

Instant Sign Up:

No

Employee Cards:

Free employee cards

Virtual Card:

No

Branded with Company Logo:

No

Late Fees:

$39 or 2.99% of any past due Pay in Full amount, whichever is greater.

Startup Centric Rewards:

No

High Spending Limit:

No

No Personal Guarantee:

No

Integration with Accounting Software:

Yes

Spending Management Tools:

Yes

Here are some benefits of the Ink Business Cash Credit Card from Chase:

- The first $500 spent on gas, dining, and select business expenses each account anniversary year earns you five points per dollar (i.e., 50% more rewards).

- You can also get 80% back as a statement credit when you use your Ink card to make purchases at office supply stores like Staples or Office Depot®. That's huge for startups who are always looking for the best deals! Plus there is no limit on how many times this benefit applies within a 12 month period*. (*)

The annual fee is $0* which means it won't sneak up on you every time your bill comes around.* There's an EMV chip built into this one so using it abroad will be much less of a hassle.

Card Features and Benefits

Annual Fee:

No Annual Fee

APR:

0% fixed Intro APR for the first 12 months that your Account is open. After that, 13.24% to 19.24%, based on your creditworthiness.

Credit Limit:

N/A

Rewards:

Earn $500 bonus cash back after you spend $3,000 on purchases in the first 3 months after account opening. Earn 5% cashback on the first $25,000 spent in combined purchases at office supply stores and on internet, cable, and phone services each account anniversary year. Earn 2% cashback on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cashback on all other purchases–with no limit to the amount you can earn.

Foreign Transaction Fees:

3% of the amount of each transaction in U.S. dollars.

Eligible Companies:

N/A

Instant Sign Up:

No

Employee Cards:

Free employee cards

Virtual Card:

No

Branded with Company Logo:

No

Late Fees:

$39

Startup Centric Rewards:

No

High Spending Limit:

No

No Personal Guarantee:

No

Integration with Accounting Software:

Yes

Spending Management Tools:

Yes

Here are some of the benefits of the Blue Business Plus Credit Card from American Express:

- No annual fee* for our business customers or any fees at all, in fact.

- A credit line with no pre-set spending limit (unlike other cards that set a hard limit on your purchases).

- EMV chip technology to help keep transactions safe abroad and online.

The American Express Blue Business Plus Credit Card comes with many perks that could save you money and time as it's designed specifically for small businesses like yours. The card has 0% introductory APR† so there is no interest when you spend up to $50K per year*. (*)You'll also get: 2X points on the first $50,000 spent in purchases each year‡ 1X points on purchases thereafter.

Card Features and Benefits

Annual Fee:

No Annual Fee

APR:

Pay 0.0% introductory APR on purchases and balance transfers for 12 months from the date of account opening. After that, your APR will be a variable rate, 13.24% – 19.24%, based on your creditworthiness.

Credit Limit:

Not disclosed but based on payment history, credit record, and financial resources, the bank may give the ability to spend above the credit limit with Expanded Buying Power.

Rewards:

Earn 2x Membership Rewards® points on everyday business purchases up to $50,000 with no category restrictions. Earn 10,000 Extra Membership Rewards® points after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership.

Foreign Transaction Fees:

Pay 2.7% of each transaction after conversion to US dollars.

Eligible Companies:

N/A

Instant Sign Up:

No

Employee Cards:

Free employee cards

Virtual Card:

No

Branded with Company Logo:

No

Late Fees:

Up to $39

Startup Centric Rewards:

No

High Spending Limit:

No

No Personal Guarantee:

No

Integration with Accounting Software:

Yes

Spending Management Tools:

YesHere are some of the benefits of the Ramp card that makes it a great fit for your business:

- No annual fee* or any other fees to use the card and no pre-set spending limit (unlike other cards that have hard limits on purchases).

- EMV chip technology. o 15 points per dollar spent†, which is four times more than most rewards programs out there. You can get even more by doing one of these three things: activating your Ramp Bonus Card, referring friends who also sign up with a Ramp card, or setting up a direct deposit and/or automatic bill pay through our free mobile app.

Ramp's goal is to make life easier for you so you can launch your online company into a success.

Card Features and Benefits

Annual Fee:

No Annual Fee

APR:

0% including no card fees, no platform fees, no late payment fees, or other fees.

Credit Limit:

N/A

Rewards:

Earn 1.5% cashback on all purchases. “Ramp Savings” to help identify overpayment or double payment of SaaS tools. Partnerships with many partners for rewards

Bottom Line Best Credit Card for Startups

So what was your pick based on the best business credit card for startups criteria set up at the beginning of this blog post? Were you swayed by points? Prestige? Brand loyalty? Or did you crunch the numbers along with the features and benefits and came up with a card choice you never expected. Let’s see where the experts netted out.

According to Abstract Ops: An automated back office for early-stage CEOS, Brex is the best business credit card option for startups that have at least $50K in their bank account. For very early startups, Divvy or Ramp is the best business credit card choice.

Surprised? Stay tuned to the FunnelDash blog for more financial information, insights, and recommendations that can help move your online business forward.