When the CEO of a software company that was rated #1 on the 2019 Entrepreneur 360™ list offers his insights about the financial fundamentals that led to 356% growth over the past 3 years , it pays to listen.

Closely.

Which is why I’m bringing you some of the highlights of our Rich Ad, Poor Ad podcast conversation with ClickFunnels CEO, Dave Woodward. In case you’ve been living under a rock for the last several years, ClickFunnels is a company founded by Russel Brunson that sells software that helps entrepreneurs and business owners generate leads and market their products and services online.

These guys are spending $750K to $1M a month on paid media which is just mind-blowing in itself. But the real financial story for this powerhouse company is how they’ve turned the payback period upside

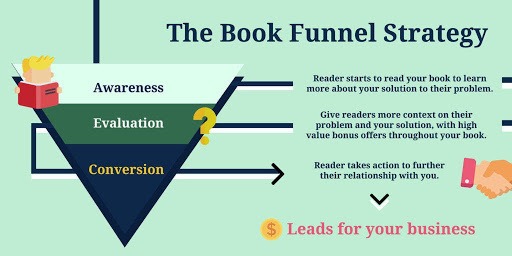

down on acquiring customers with their book funnels

Most B2B SAAS companies are doing free trials of the software with payback periods of 6 to 12 months. ClickFunnels on the other hand, is making money instantly on lead acquisition.

You heard me right. Instantly. They’re focusing on profitability long before they even start selling their core subscription offer.

According to Dave, there’s a reason why selling the software upfront doesn’t really work for them (or most anyone else) -- and a reason that their book funnel works . Keep reading to the end because also he tosses in some golden nuggets of advice about funding at every stage of a company’s growth.

1. Flipping the Script on the Payback Period.

“We need a 30 day payback on the ads we run and that's pretty tough. So you actually get a free trial. What's a 14 day free trial with a credit card to get paid and make your money back in a month. So for us, I can tell you right now it would cost us anywhere from $135 to $142 for a free trial.

We're converting at anywhere between 42% and 47%. And I'm just not going to pay to get a person to make $97. I then have to spend almost $300 and I've got a three month payback on it. I can't afford to do that.”

“And so instead we sell a book like our recent Traffic Secrets. We always look at trying to get our cash cost to acquire a customer to equal or be equal or less than whatever our average car value is. So, the cost to acquire a customer on a book funnel right now is about 17 to 20 bucks.

Our average cart value on that is anywhere in the neighborhood of $52 to about $58, $60. And then you look at the book cost and the fulfillment, everything else and then toss another 20 bucks in there. We actually make money on acquiring that customer.

But the real key that we've noticed is yes, it takes a little bit longer to make that conversion from book to actual ClickFunnels, right? But what we found is the indoctrination that takes place and the trust that exists because they've actually gone through and consume content makes the buyers so much better. And for us, anytime we're trying to sell something, I would much rather have a buyer lead than an offer lead.”2. Financing Fundamentals for Startups

“Obviously on a startup, bootstrapping is the way to go. I think the key right now, when I look at a company that's getting going is that you need a proof of concept. And there's no better proof of concept than a customer actually taking out their credit card and paying you something.

So for a company who just thinks they're going to go out with an idea and have someone else invest in it? I'm totally against that. I think you need to go ahead and you need to bootstrap this year. I think part of the debt that comes into play is credit cards. I think debt, as you scale and grow a company starts to have a role, especially a SAS company. These days, you can typically get about three times your EBITDA on debt.”

3. Cash is the KING of Kings -- Especially Right Now

“ I think it's important these days to have cash and have access to cash. I believe we're going into a time after the first of the year where you're gonna see a lot of businesses for sale. And we definitely want to have cash on the sidelines to acquire those. And I would do that through debt for sure.

As far as VC... I'm not a huge VC guy. I'm probably more the private equity, growth equity. That said, I think that once you've got a proof of concept and you've scaled, there definitely comes a time when it's probably worth taking a look at a PE growth equity. And not necessarily for the financial investment, but more from the knowledge, the wisdom and things companies of that size provide.”

Looking for the best charge card for Facebook ads with the highest limit for digital ad spend guaranteed? .

The average small business has 5 credit cards with a balance of about $32k that they have to keep track of. There’s a better way than rotating through dozens of low limit credit cards to get the funding you need to scale when you can get it all with AdCard -- the best card for Facebook ads with the high limits and more you need to grow your business.

Exclusive Cardholder Benefits

Not ready to buy a yacht but interested in taking a smarter, less conventional approach when it comes to funding your company or client ad spend? Check out AdCard -- the first digital ad spend card that helps you get the funding you need to scale with more cashback, more cash flow, and more control.

Using this unique funding tool can help jumpstart your business with FREE benefits likeAnd you’ve got a funding option that you definitely need to consider if you’re spending $10k a month on ads or more