Get All Your Questions about Partnering with AdCard Answered Here.

Since we first rolled out AdCard last year, we’ve had a ton of interest from individual ad buyers who want to take advantage of the card’s powerful, up-to-4%-cashback on Facebook and Google ad spend feature. Which, is totally understandable now that earning points has lost its luster and agencies are realizing that the key to scaling is taking advantage of the kind of massive cash infusion that AdCard provides.

But we’ve also had a lot of interest from businesses that have thousands of affiliates or followers who want to know more about the massive revenue-generating opportunities they can get by partnering with FunnelDash on a co-branded credit card.

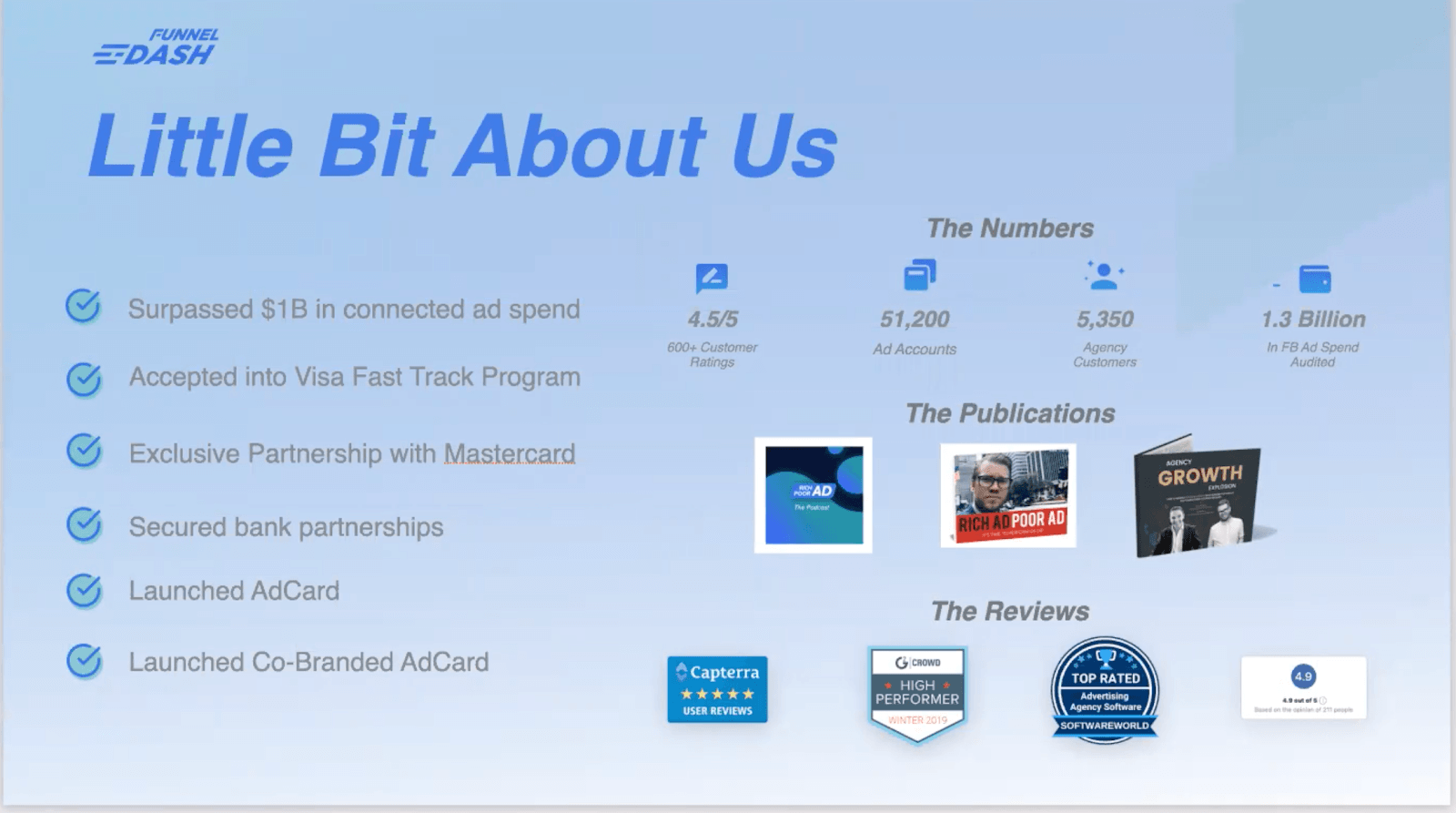

Some of the Biggest Online Advertising Brands Are Way More than Just Curious.

Our friends at DigiStore24 wanted to know more. So recently, I sat down to talk with their finance guy, Anthony Kossatz, and Darcy Erikson, their Director of Growth Management about what they wanted out of a partnership and what AdCard could offer them.

Just to give you a snapshot of who they are, DigiStore24 is the leading reseller-based online sales solution in German-speaking countries and has one of the largest affiliate networks in Europe. They offer all-in-one solutions for digital products and event organizers that allow online businesses to become completely automated and scalable.

Category Co-Branded Credit Cards Have Become Incredibly Popular in the Consumer Market

And no wonder. They’re a great way to show and share the love with customers with a product that pays big benefits for companies that offer them. Co-branded cards have worked phenomenally well for billion-dollar, big-box retailers like Costco by giving them powerful tools for:

With AdCard, we’re bringing that and a lot more to the world of B2B. Instead of a card for consumers who spend a lot on a category like home goods, we’re a card for businesses that spend a lot on advertising. Which is perfect for a business like DigiStore24.

How an AdCard Co-Branded Credit Card Works

With a co-branded card, FunnelDash is essentially playing the role of a Chase or Citibank managing the payments, the risk, the underwriting, the issuing of the card. A co-brand partner like DigiStore24 would be driving the financial and brand benefits of the card to their affiliates and followers.

Once FunnelDash developed the card design and DigiStore24 nailed down the benefits, we'd spin up a landing page that would serve as the entry point into signing up for the card.

Each AdCard program is designed to appeal to different sets of audiences. And so DigiStore24 would have to decide what benefits their target cardholders care about most, which could include things like:

Then we would want to look at how we would want to position the DigiStore24 card. We could do a high-end Amex Black Card style rewards card which would charge initiation fees of $10,000 and annual card fees of 5,000 and deliver better benefits than a Tom Ford wallet or a Saks Fifth credit. Or we could do more of a Platinum approach that would charge something like a $550 annual fee.

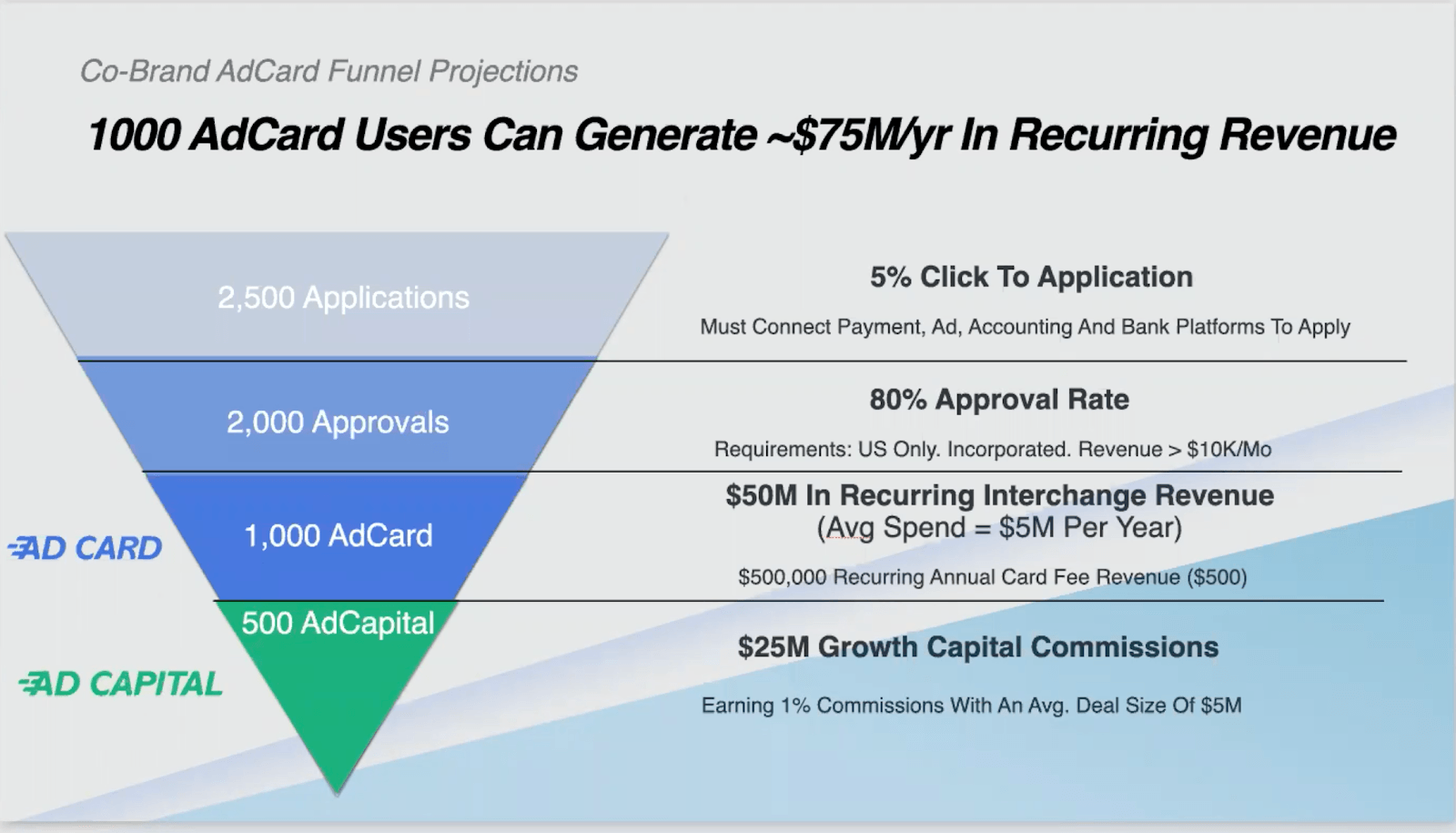

Let’s Do the Math

This is where potential AdCard co-branded credit card partners really sit up and take notice. And when I laid out the details for DigiStore24, they were no exception.

So let’s break it down. DigiStore24 has a $100 million in ad spend per hundred cardholders. So, they’re looking at about 1.6 million in revenue between cardholder fees, interchange, and the capital deployment on the back end. Those are kind of the three revenue drivers.

As DigiStore24 got to closer to 500 cardholders, they’d be looking at about $300 million in ad spend, and $3.2 million or 3$.7 million on the interchange, cargo fees, and capital.

Now the multiplier effect here is what does it actually look like to be deploying $25 million to $100 hundred million onto some of the winning offers? And what would be the compounding effect of that in terms DigiStore24? That’s a homework assignment where they’d have to run the math internally.

In addition to the tremendous financial upside of offering an AdCard co-branded credit card, there’s another more fundamental benefit.

DigiStore24’s affiliates are already spending a lot of money on advertising. The company wants a way to give those affiliates the ability to spend more on ads. When they spend more, they’ll generate more revenue which will strengthen the affiliate’s relationship with DigiStore24 -- and that’s a long-term business win-win for everyone.

Why Your Affiliates and Followers Will Love Your Co-Branded AdCard.

For Starters -- It Offers the Highest Cash Back and Credit Limits for Facebook Ad Spend

The average small business has 5 credit cards with a balance of about $32k that they have to keep track of. There’s a better way than rotating through dozens of low-limit credit cards to get the funding they need to scale when they can get it all with your co-branded AdCard -- the best card for Facebook ads with the high limits and more your affiliates and followers need to grow their business.

Exclusive Cardholder Benefits