Getting the big picture on your ad campaigns’ success starts with one simple equation.

In the hyper-competitive world of online marketing, data reigns supreme when it comes to improving ad performance and profits. In the U.S. alone where companies spend more than $125 billion on digital advertising, understanding what your return on ad spend (ROAS) is, is a critical metric for measuring success.

Unfortunately, too often marketers focus on small picture data like quality score, cost per conversion, and click-through rates when they need to understand the much bigger picture that ROAS provides. ROAS lets you know how well a digital advertising campaign is working by measuring the amount of revenue your business brings in for every dollar you spend on advertising. It’s pretty much the same as ROI, or return on investment but is most often used when referring to money spent on digital advertising.

ROAS calculations provide insights on which methods are working in order to optimize ad spend to generate the maximum amount of revenue. This critical information, combined with customer lifetime value across all campaigns, drives strategy, future budgets, and helps to guide the overall marketing direction.

Why does ROAS matter?

Unless you’re the rare internet marketing bird who’s specifically focused on raising brand awareness, you should be treating revenue as the gold standard outcome of your ad campaigns.

Tracking your ROAS throughout an ad campaign lets you see the campaign’s performance over time. This will help you determine whether the campaign is generating the revenue you expected it to generate, and help you decide whether you should renew the campaign or change or abandon it to avoid wasting more of your ad budget.

If you’re answering to higher-level executives or VCs, they are going to be extremely interested in knowing exactly how much revenue your advertising and marketing efforts are bringing in. Tracking ROAS will make providing accurate answers easy.

In addition, ROAS calculations can help you figure out which ad campaigns are truly driving results. They can give you insights on how you can improve your future online advertising efforts based on the ad groups and keywords that are working. Plus, by using ROAS, you can continuously refine your ad spend to maximize revenue generation.

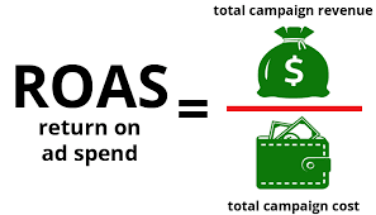

How to calculate a simple ROAS

Basically, the ROAS equation boils down to Gross Revenue from an Ad Campaign divided by the Cost of the Ad Campaign.

So say, for example, you spend $20,000 on an ad campaign in a single month. During that month, the campaign generates $100,000 worth of revenue. $100,000 divided by $20,000 = $5. Consequently, your ROAS is a ratio of 5 to 1 or 500%. That means for every dollar you spend on advertising you make $5.

How to calculate a more realistic ROAS.

Simply using what you pay Facebook or Google to run your ads as the Cost of the Ad Campaign will give you a rosier ROAS picture, but it won’t be a meaningful real-world measurement

In reality, the actual Cost of an Ad Campaign includes much more. To calculate the total cost you need to factor in the total cost of a one month paid search campaign which as an example might include the following expenses:

Now it’s time to calculate the revenue brought in by the ad campaign which is a little more complicated than simply looking at your bank account. As a starting place, you’ll want to determine how much a new lead is worth to your business. Then you’ll want to calculate the total profit margin for different purchases. That will give you a more accurate idea of what your actual ad revenue is.

So here is a hypothetical calculation:

Now you can use the ROAS formula of Total Revenue/Total Cost, which works out to be $5,200 revenue divided by $3,400. That comes out to a $1.50 ROAS. You earned $1.50 on every ad dollar you spent. So is that a good ROAS or a bad ROAS?

Make sure to include ALL your costs.

You may have other costs in addition to software and management fees, so if they apply, don’t forget the following factors:

Partner and Vendor Costs -- These might be fees and commissions paid to partners and vendors that help run the campaign or channel level. Tabulating an accurate accounting of in-house advertising personnel expenses such as salary and other related costs has to be part of the equation otherwise the ROAS won’t explain the efficacy of individual marketing efforts and hurt its utility as a metric.

A0ffiliate Commissions -- Add in the percent commission you pay to affiliates, as well as what you pay in network transaction fees.

Clicks and Impressions Costs -- Metrics including average cost per click, the total number of clicks, the average cost per thousand impressions, and the numbe0r of impressions actually purchased.

What’s a good ROAS?

The answer to most questions of this type is “It depends.” Nevertheless, understanding whether you’re getting a good, bad, or average return on ad spend for your situation is essential. It helps you set a benchmark for your ad strategies, as well as show where your company can improve the performance of its ad campaigns.

An acceptable ROAS for your company will depend on your profit margins, operating expenses, and the overall financial health of the business. In general, a rule of thumb good ROAS benchmark is a 4:1 ratio — $4 revenue to $1 in ad spend. If you’re a cash-poor startup you might need higher margins. If you’re an e-commerce store that’s committed to growth you probably can afford higher advertising costs.

Some businesses must have a ROAS of 10:1 to stay profitable. Others can do quite well with a ROAS of just 3:1. In order to gauge a ROAS goal for your business, you need to have a defined budget and a solid understanding of your profit margins. If you have a large margin, it means that the business can survive a low ROAS. If you have smaller margins, it means that you are going to have to maintain low advertising costs. If you’re an e-commerce store in this situation must achieve a relatively high ROAS to reach profitability.

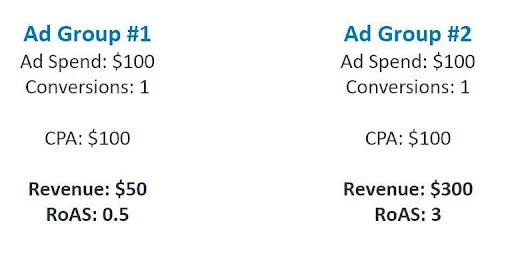

Why ROAS is a better metric than CPA

One of the most common metrics used to figure out the success of a paid search campaign is CPA, which is “cost per acquisition” or conversion. While CPA is very useful for measuring the volume of conversions, it only measures the average cost associated with any one, single action.

To give you an idea of the difference, take a look at the two ad group examples below.

As you can see, both ad groups spent $100 and got one conversion which means they have identical CPAs of $100. But when you look at the value of each conversion, though, the picture changes dramatically.

Ad Group #1 generated $50 from that $100 spend while Ad Group #2 generated $300, giving us a ROAS of 0.5 and 3.0, respectively. That’s a significant difference in return for the same amount spent. Achieving a ROAS of less than one is a losing proposition since you would be earning less than $1 for every $1 spent. The ROAS of 3.0 is showing that for every $1 Ad Group #2 spent, it earned $3 back from that conversion -- which is a 200% return. In a profit-focused strategy, the goal is to achieve as high of a ROAS as possible.

ROAS in the Real World: Mindful Marketing Case Study

So how what does calculating and tracking ROAS look like in the real world? How can it help companies optimize ad campaigns and increase profits?

Here’s a look at a case study by Mindful Marketing Co. an e-commerce, social media, and training agency located in Abbotsford, British Columbia, Canada that details how they increased a client’s e-commerce stores by 1,387% in six months. (Note: Because nature of products sold in this store, they were unable to utilize Google’s very effective retargeting capabilities but were still able to generate a strong return on investment and ad spend.

The ROAS Goal

Increase ROAS (Return On Ad Spend) and increase sales. At the start of this effort. ROAS was at 1:0 - which is essentially breaking even. Mindful Marketing’s absolute minimum baseline ROAS for any e-commerce campaign is 2:0, with a benchmark ROAS of 4:0.

The Strategy

Their plan was to implement corrections, collect data, identify ideal customers, and get the product in front of them. Then they’d scale the strategy - removing what doesn’t work, and doubling down on what does.in order to maximize ROAS.

The Implementation

- 1Their first step was to fix issues with conversion tracking. Without correct conversion data, it would have been impossible to manage the account and scale. Conversion data told them information about who buys, when they buy, and what they buy. They used this to identify trends and make campaign decisions.

- 2Their client had added many, many keywords hoping these would show ads to buyers. The sheer amount of keywords meant that the ads were being shown to many people who would never buy - and this was a waste of ad-spend. Mindful Marketing’s approach was to observe all points of data - impressions, clicks, click-through-rate, and conversions - and determine which keywords were simply costing money but not performing.

- 3After a certain test period, all under-performing keywords were removed. Eliminating the wasted ad spend would simply drive more traffic through the keywords that were producing desired results. Eventually, the only keywords left would consistently produce results and sales.

- 4They used a similar strategy with ad copywriting - multiple variations of each ad were produced, for each ad grouping. At the start of each month, the lowest-performing ad variation was removed, and a copy was made of the best performing ad, with a minor change to test if it would perform even slightly better than the current best-performer.

- 5As sales increased, more ad-spend was fed to the ad groups producing the most sales. This became a snowball effect - more sales created more conversion data which helps optimize for more sales which created even more conversion data.

- 6As a general rule, Mindful Marketing always runs a retargeting campaign to have ads re-appear in front of potential customers who have visited the site. However in this case, due to the sensitive nature of the products being sold, we were unable to leverage this powerful tool. Otherwise, the ROAS and ad performance would have been even greater.

The Results

At the beginning of the effort, the e-commerce store’s ROAS was literally non-existent. It gradually got better and more effective month after month. At the end of the first 6 months, the store’s ROAS was 14.87 (That is $14.87 of revenue for every $1 of ad spend) and the overall 6-month ROAS, including the non-existent start, was 10.54 Mindful Marketing’s strategy of tweaking tactics and keeping an eye on ROAS took the store’s sales from $800 in the first month to just under $40,000 in the 6th month.

Add ROAS to your arsenal of marketing tools.

Simply dumping a ton of money into an ad spend doesn’t always translate into higher revenues. What does is spending wisely on your best-performing ads that drive more sales and grow your revenues significantly.

ROAS calculation results are valuable in helping you identify the ad sets and campaigns on which you are over or under-spending. If you’re overspending you’ll need to reduce your budget to protect your business from losses. On the other hand, if your ROAS calculations show an ad set or campaign is kicking butt, they will give you the confidence to step on the gas in terms of ad spend. ROAS is just one more tool to help you make the most of your ad spend dollars.

The average small business has 5 credit cards with a balance of about $32k that they have to keep track of. There’s a better way than rotating through dozens of low-limit credit cards to get the funding you need to scale when you can get it all with AdCard — the best card for Facebook ads with the high limits and more you need to grow your business.

Exclusive Cardholder Benefits