Decide what you need and check out the fees before you choose a credit card payment processor.

Chances are that the list of things to do in order to get your business up and running include things like setting up a website, securing funding, and putting together a marketing plan. However, it probably doesn’t include choosing the best credit card payment processor -- but it should.

Because whether you’re opening a brick-and-mortar retail store or launching an eCommerce enterprise online, setting up a way for your customers to buy your products and pay for them is probably one of the most important things you need to do. This is why it pays to spend some time doing a little research to identify the best credit card payment processor to verify and confirm credit and debit card transactions.

What is a credit card payment processor?

A credit card payment processor is a company that acts as an intermediary to deliver money from the customer’s bank to the merchant’s bank. Your payment processor will handle company transactions so that customers can buy your products or services.

Payment processors specialize in different types of transactions for instance online vs in-person. Payment processors will create agreements that include a variety of fees and usage terms. They also help maintain the security of transaction details and handle issues like fraud or chargebacks. Here’s what they do:

Verify that the form of payment is good.

What that means is the payment processing company relays information from your customer’s credit or debit card to both your bank and your customer’s bank. If it’s a debit card, they verify if there are enough funds in your customer’s account and whether or not the card is valid. If everything checks out, the transaction will go through. The amazing thing is that it all happens in a matter of seconds.

The credit card payment processor also takes security measures like making sure that the customer’s data is correct. Credit card fraud is always a concern. Part of the credit card payment processor’s required duties is to watch out for suspicious activity and prevent fraud.

Clean up accidental charges.

But preventing fraud is just part of a credit card payment processor’s job. They also remedy accidental transactions. So if a customer claims and proves that your company incorrectly charged them, the payment processor will take care of the accidental transaction.

The customer will not be charged for remedying the accidental transaction, but they will charge your company a fee. So if you accidentally make an error during checkout or a customer isn’t satisfied with an item and returns it, your company will incur a fee for having to transfer funds from your account to the payment processor and then back into the customer’s account.

Each payment processor specializes in different types of transactions, for instant online versus in-person payments. They’ll draw up agreements that cover a variety of fees and usage terms. They also help assure the security of transaction details and deal with fraud issues and chargebacks.

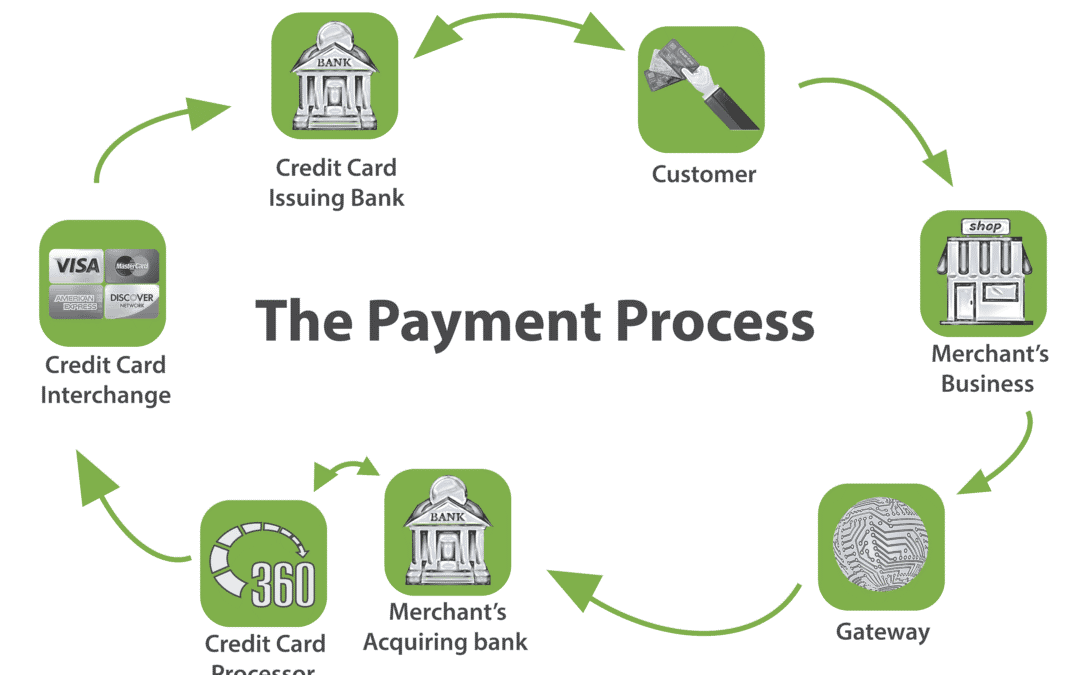

So how does credit card payment processing work?

From a customer viewpoint, credit card processing basically involves a quick swipe of their credit card. But that simple swipe triggers a complicated chain of actions that initiates an exchange of information, sends and records payment, and completes the transaction.

To give you an idea of how credit card processing works, let’s begin by identifying the players:

What happens during credit card processing?

When a customer uses their credit card to make a purchase from your business, this is what happens during the transaction:

- 1The customer makes a credit card payment to the merchant when purchasing online or in-store.

- 2The credit card processing service routes the customer’s payment information to the credit card network via internet connection.

- 3The credit card network sends transaction data to the card-issuing bank for authorization.

- 4The bank authorizes the payment and places a hold on the amount. Or if there are insufficient funds or they suspect there is fraud they’ll send a denial. This all usually takes less than a minute.

- 5The credit card processor then sends transaction authorization or denial to the merchant.

- 6The merchant settles transactions in a batch which they typically do once a day, with help from the credit card processor.

- 7When the credit card processor requests settlement, the customer’s bank releases funds to the merchant’s bank.

- 8The credit card processor takes out the interchange and other fees and then deposits funds in the merchant’s bank account. Deposits can usually appear within two days, although some processors may have faster turnaround times.

- 9Providing the charge was approved, the customer takes home their purchase.

6 easy steps to choosing the right payment processor.

There are a lot of different kinds of payment processors that offer a wide range of terms and services. That means you’re going to have to do a deep dive in terms of educating yourself and doing the numbers to find out which processor will best meet your needs and earn you the greatest dividends. Here’s a step-by-step process to follow in order to choose the right credit card processor for your business.

1. What kind of account should you choose?

Third-party processors

First, let’s define our terms. Third-party processors are those that handle credit card transactions outside of your store or application. They often charge slightly higher transaction fees, but on the plus side, you won’t need to worry about PCI compliance (payment card industry compliance) or integrations. Square and Paypal are good examples of third-party processors.

Merchant accounts

Another option is a merchant account. Your business might want to choose this option if you want credit card payments to happen within your own network. Merchant accounts involve some underwriting and setting one up is more complicated, but it gives you better control and lets you offer a higher level of customer service.

Which kind of account would be the best choice for your business?

Your answers to these questions will lead you to make the right choice.

Choose a third-party processor if: | Choose a merchant account if: |

You’re a small business that has 50 or fewer employees | You’re a bigger company with more than 50 employees |

You don’t do many transactions | You want more control |

You value simplicity | You want all transactions to occur within your platform |

You have bad or no credit | You want low transaction fees |

2. What level of customer service do you need?

You’ll want to take into consideration how often you get special requests, have problems, or experience complications that need you to get help from your credit card processor. Snags with credit card payments can cause you to lose customers. This is why why it’s very important to check out what kind of support your payment processor provides. Don’t be shy. Ask them questions about their support process, availability, protections, and how much control you’ll have over customer payments and payment portals. If they don’t offer the kind of backup you.

3. What kind of POS, mobile, and online features do you want?

You might be a company that is 100% e-commerce, or you might process the majority of your transactions via a virtual terminal. Conversely, you may be a business that needs fast and reliable credit card payments for in-store, point-of-sale (POS) transactions. Or you might need a combination of all three ways to pay. In any case, you’ll want to take a close look at the way your customers shop and look for payment processors that specialize in the methods your customers prefer.

Since COVID-19 came into play, contactless payments have become more popular. Processors like Square, Shopify, Paypal, and others offer mobile credit card readers for easy POS transactions that don’t require physically handling credit cards.

4. What level of security and PCI compliance do you need?

Your customers rightfully expect that buying from you will come with secure payment processing that protects their data. This is why you’ll want to pay close attention to whether or not your credit card processor can ensure your operations are PCI compliant. You’ll want to make that any point-of-sale terminals or online payment providers encrypt data to protect both you and your customers.

5. How highly do you value transparency?

You probably will want to steer clear of credit card processors who are reluctant or slow to share information. Communication and transparency are essential to a healthy business relationship. As you evaluate different payment processors, look at how forthcoming they are about their pricing models and how clearly they communicate with you when you ask questions about their service. When it comes to working with credit card processors, surprises aren’t a good thing. Be sure to get reviews of the service you’re considering, especially in terms of unexpected charges or changing fees.

6. How well does the math work?

Credit card payment processing is all about collecting money -- and you don’t want to sacrifice a cent if you don’t have to. You might be drawn to the simplicity of a flat-rate model but that doesn’t mean it’s the smartest financial option for your business. The fact is, more complicated pricing models may save you money in the long term. They might also offer you better flexibility as well as appealing benefits like lucrative rewards and spend tracking.

A good exercise to do is have your potential payment processor run their various pricing models with your last month’s transaction numbers. When you see how those numbers come out you will have a better idea of what each payment processor could do for your business. If they can’t or won’t run the simulation, you should still run the numbers yourself or with your finance team. You may be surprised to find out that a flat-rate monthly subscription would actually cost you more than a higher rate set up, or the other way around depending on your business.

Be aware of credit card processing fees

Unlike cash, when a customer buys something from you using a credit card you don’t get 100% of the money. The convenience and service of using a credit card payment processor will cost you something in fees for every transaction.

Being aware of these sometimes hidden fees will help prevent unpleasant surprises. The fact is that many credit card processors charge additional fees beyond the interchange (from the credit card network) and markup (from the processor). Some credit card processors can even adjust fees (ie. raise them) without warning. So be sure to read the fine print on your agreement and always check your transaction statements. Catching errors or realizing you’re paying higher than average fees can save you money and may lead you to switch processors.

What kind of fees do credit card payment processors charge?

Credit card processors all do pretty much the same things in terms of tasks,, but they don’t all charge the same fees to perform them. Here is a list of the most common fees to figure in as you shop for a credit card processor for your small business:

While nobody likes to pay fees, none of these charges should completely put you off. However, as with all things financial, it’s important to understand and identify these fees while you evaluate the pros and cons of various credit card processors for your business.

Take a look at credit card processing pricing models

While fees are an important consideration, they are just one piece of the larger credit card processing model puzzle. In order to make a well-informed decision about which payment processor to go with, you’ll need to do the math with each individual pricing model to see which one will meet your needs and cost the least in the long run.

Flat-rate pricing

A popular choice because of how easy and straightforward it is for budgeting, a flat-rate model charges the exact same amount for every transaction regardless of the number of transactions made each month or how much the transactions total. While the transaction fee might be slightly higher than with other processors, but it’s usually the only fee that the processor will charge. So you don’t have to worry about paying monthly or other extra fees.

A great choice for small businesses

Flat-rate pricing models are usually designed for small businesses or companies that don’t do many transactions. They are perfect for startups, e-commerce, and hobby businesses because a flat-rate credit card processing service won’t charge extra for failing to meet monthly minimums. Another bonus is they won’t take unexplained percentages of each transaction.

Cost-plus pricing

More often than not established businesses choose cost-plus pricing because it offers transparency for each transaction. Every transaction will show the interchange fee as well as the processor’s markup which is usually a combination of percentage plus a flat fee.

If you have a high number of transactions each month, you should consider a flat-rate/cost-plus hybrid model which can help you save money on credit card processing. Although this model requires a monthly subscription, it features lower markup fees on each transaction.

A great choice for established businesses.

Cost-plus pricing models are a good option for businesses that have a regular and significant volume of credit card transactions each month.

Tiered pricing

This is a complicated option. With a tiered pricing model, each credit card transaction is classified and assigned a tier that is charged at a different rate. These classifications can be confusing and you don’t get much info on the transactions. The way it works is that each transaction is sorted into classification categories of qualified, mid-qualified, and non-qualified. Qualified transactions are given a very low, favorable rate (which often attracts businesses). The downside is that they make up this favorable rate by charging higher credit card processing rates on non-qualified and mid-qualified transactions. Be aware that these fees can be changed without notification.

A great choice for companies paid with debit and non-reward credit cards.

Before you dismiss the tiered pricing model, take a look at the payment method for most of your transactions. If a high percentage are paid with debit or non-reward credit cards, most of your transactions would be classified as qualified which means you’ll pay a very low markup rate.

Who are the largest credit card, processors?

Credit card processors first came online back in the 1970s. Most of the biggest credit card processors are the oldest, including:

Old school credit card payment processors versus newcomers

While time-tested big processors offer stability and experience, there are many market disruptors who are making waves in the credit card processing industry. Up-and-coming credit card processors are offering innovative options to provide solutions for small companies, e-commerce, technology integrations, and more.

Take, for example, the ubiquitous mobile credit card reader company Square. Founded in 2009, it has been a top choice for startups and innovative entrepreneurs for over a decade. But new processors aren’t your only choice if you want cutting-edge technology. Because Square and other new processors are spurring old-school credit card processors to develop more tech-savvy solutions to compete against the upstarts.

What are the best credit card payment processors of 2021?

So now that you know what to consider and who the major players are, it’s time to take a look at the top picks for credit card payment processors for 2021

1. PaymentCloud specializes in E-commerce & integrated business software

2. FiveStars is focused on local small businesses

3. Flagship offers low pricing & integrated Business Management Tools

4. NationalProcessing offers top-rated customer support with transparent pricing

5. Stax offers low rate subscription-style merchant services

6. LMS offers simple and hassle-free plans with low rates

CreditCardProcessing has simple flat-rate pricing options for all business types

Square has rates that are on the high side for most businesses

Which credit card payment processor is right for you?

Choosing the right payment processor can make your life much easier. In addition to convenience, a credit card processor can offer you better dividends and increase the number of customers who purchase from you because of the accessibility of payment.

Which credit card processor is best for your business depends on your company’s size, budget, and needs. The most important thing for you to do is to aggressively crunch the numbers on varied percentage and markup fees so that you don’t fall into the trap of choosing the simpler (but more expensive) option. Do your homework and you’ve got this.

The average small business has 5 credit cards with a balance of about $32k that they have to keep track of. There’s a better way than rotating through dozens of low-limit credit cards to get the funding you need to scale when you can get it all with AdCard — the best card for Facebook ads with the high limits and more you need to grow your business.