American Express. Citi. Chase. Mastercard. Capital One. Bank of America.

What’s in your wallet? Probably one or more of those bank-backed cards. The fact is, the average small agency has five credit cards with a balance of about $32k that they rotate through to buy Facebook and Google ads.

If you’re like them, you probably use different ones to get different benefits including points, cashback, product and service rewards, and other spiffs that credit card companies offer.

You might also be using different cards to take advantage of their various levels of credit limits. When one maxes out you move on to the next. Right? No big deal.

Actually, credit limits are a HUGE deal when it comes to spending tens of thousands or even hundreds of thousands of dollars a month on Facebook or Google ads.

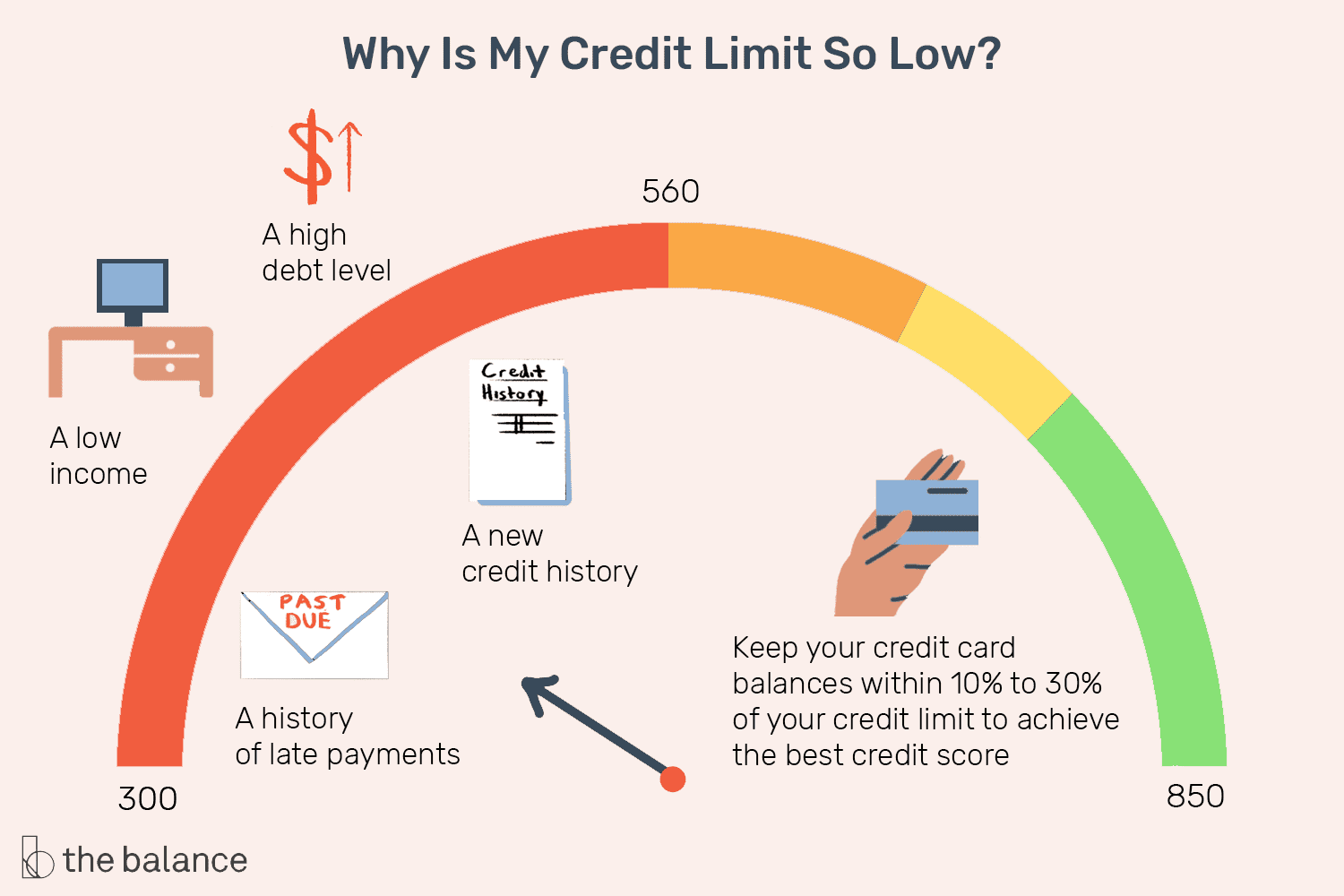

So what determines the credit limit on a credit card?

Just to define what we’re talking about when we say “credit limit”, it’s the maximum balance the bank allows you to have on your card at any given time. Once you hit that limit, the bank shuts off your card until you pay off at least some of your balance.

What happens when you keep hitting your credit limit on a hot Facebook ad campaign?

If you’ve been in the happy situation where money is pouring in almost as fast as it’s going out, you’ve experienced the administrative nightmare of having to send in payments on your low-limit credit cards every other day to avoid the limit and keep the machine running.

If things are going particularly well and you’re looking at hitting your limit over weekends, you end up having to pay the credit cards in advance so you have enough headroom to make it to money. And sometimes, that’s money you don’t have in the bank at the moment. So what’s the answer?

How to get the cash you need to fund ad spend.

If you’re buying Facebook or Google ads for your clients, you know that even five credit cards that each have a $20,000 credit limit won’t get you very far, especially if you have a hot campaign you need to scale. Where are you going to get the funding you need?

You have a few options.

Fortunately, there’s a MUCH better way to fund Facebook ad spend

At FunnelDash, we’ve seen first hand the roadblock credit limits put in the way of potentially super-successful efforts to scale. Whether it’s the 20- year-old entrepreneur whose ad campaign is tearing it up but can’t get access to the cash he needs to scale because he has no credit history -- or the 40-year-old company owner who’s in the same boat because he’s had some financial ups and downs, we feel your pain.

This is why we created AdCard in partnership with MasterCard, the first card created for advertisers, by advertisers, that provides a ton of category-specific benefits -- including…

With AdCard, your credit limit is based on how well your ads are doing -- not on your credit history. The better your ads perform, the more credit you’ll have access to. And we’re not talking about a piddling $10K more. It could be hundreds of thousands or even millions of dollars more.

Plus because we evaluate how you’re doing a lot more often -- usually weekly and sometimes DAILY -- you can get access to that higher limit almost immediately. Which is critical when you want to be able to step on the gas for ad spend.

Oh and AdCard gives you all the ad spend funding you need to grow your business without requiring a personal guarantee that could destroy you financially if things go south and without hurting your ability to secure future funding from other sources.

Take two minutes to do a mental calculation on your monthly ad spend X .04%. That’s how much liquid cash you can plow back into ad spend -- in addition to accessing a higher credit limit.

AdCard offers dozens of more benefits that are specifically geared toward helping advertisers access the cash they need to supercharge ad spend and scale like never before. So if you want to stop being stymied by low credit limits and could use the up-to- 4% cashback to take your business to the next level, you need to check it out now.