Follow these 7 simple steps to create a marketing budget to make the most of your advertising dollars.

Marketing is the engine that powers business growth. So while operating costs, inventory investments, and staffing budgets are important, without a strong marketing effort all of those expenditures represent cash outflow. Marketing is the engine that creates cash inflow. So knowing how to create a marketing budget is essential to the success of your business. But where should you begin?

Where is your business right now?

Understanding, where you are on your small business journey, can help you create a marketing that will get you where you want to go. Essentially, there are two basic categories your business can fall under — start-up or up and running.

Your status as a startup or an established business will impact how much you’ll need for the marketing budget for your small business. In general, expect to spend more when you’re in the start-up phase than once you’re up and running.

Once you’ve established where you are in terms of the maturity of your business, you can go on to take these 7 steps to create a marketing budget that will move the needle on sales in the right direction.

1. Begin by doing an audit

In order to create a marketing budget and map out a profitable future for your company that optimizes your marketing dollars, you have to look at the past. Knowing what you’ve spent on marketing and what the ROI on that expense was is a great place to start. It’s all about perspective.

So before you even think about adjusting your marketing spend or submitting budget proposals to your executive team, you need to establish a baseline. The first step is to take a close, critical look at your current marketing plan, budget, and spend.

- What are you currently spending on marketing?

- How many marketing software subscriptions do you have?

- Are you using all of them?

- What are your fixed marketing costs?

- What are your variable costs in marketing?

- What are your discretionary expenses?

- Who are your regular or authorized marketing department spenders?

- Has your company stayed within marketing spend goals or budgets?

- What are our current goals for marketing?

- Do you have an adequate emergency fund?

In addition to looking at your own company, you should research what other similar-sized businesses or marketing departs are spending on a monthly or yearly basis.

You can find this information by researching at libraries, your industry’s trade association, or by searching online for helpful articles about marketing budgeting and spending.

2. Review your analytics

Knowing which marketing efforts worked and which didn’t is the cornerstone of deciding what to spend your marketing budget on in the future. So the first step to create a markeitng budget is to start by gathering the data about each of your marketing efforts and platforms. Record it all in one database or chart so you can track your progress and identify your failures.

Understanding how a particular campaign or platform performed will help you to identify successful strategies for your business, calculate ROI, or better yet ROAS on different marketing tools you’re using. Make sure to include non-marketing data, like current customer demographics and sales statistics.

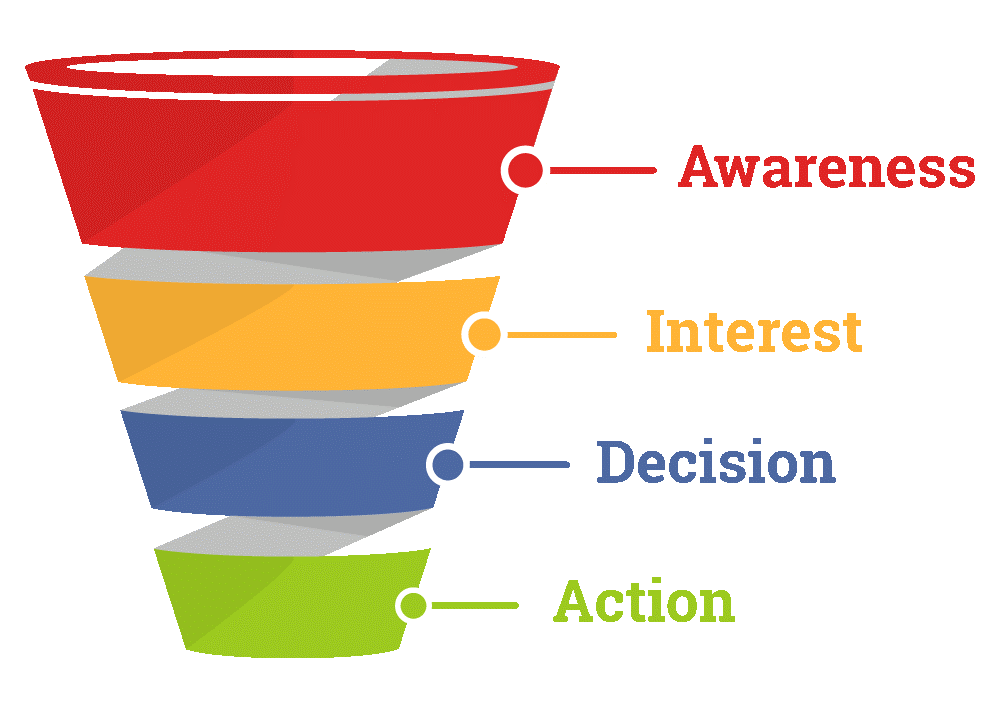

3. Understand your sales funnel

A sales funnel is the series of steps your potential customer takes in order to purchase your product or service. Delving into the details of your sales funnel will help you understand where to spend your marketing dollars. In order to create a marketing budget that focuses your funds where they need to be spent, here’s what you should be looking at.

-

Awareness

This has to do with how your customers find you in the first place. Aside from referrals and recommendations — which are marketing gold — the best place to get your product or service in front of potential customers is online social postings and paid advertising.

Unless you’re selling something like cemetery plots, walkers, or reverse mortgages that might be sold via traditional advertising like newspaper, television, or radio, online is where your potential customers are going to be shopping. These days, most companies spend the bulk of their marketing dollars on digital advertising. So when you are looking at allocating funds, that’s where your focus should be.

-

Interest

Once you’ve got your potential customer’s attention, it’s time to draw them in with more information. If you are selling something relatively inexpensive and low-risk like bubble gum, you may not have to do more than send them to a place to purchase. However, if you’re selling a higher ticket item or one that a potential customer has a lot riding on the purchase, you will need to provide them with more information, testimonials, and other forms of proof to give them what they need to know before they feel comfortable buying from you.

That may come in the form of a website or a call to a sales rep. Scrimping on this part of your sales funnel can mean that you’ve wasted the money you’ve spent to capture your customer’s interest if they have questions that aren’t being answered or objections that aren’t being addressed.

-

Decision

Once your potential customer has all the information and answers they need to make the decision to buy, it’s time to set the hook. This can be in the low-cost form of a guarantee of refunding their money within 30 days if they are dissatisfied or other reassurance.

-

Action

This step is when you push your potential customer over the edge to buy. It might be in the form of last-minute addon deal sweeteners like discounts, bonus products, or other incentives that cost money and need to be factored into your marketing budget. In the early 2010s, Williams Sonoma’s relatively short-lived Agrarian division offered a hard to resist deal closer on their $1,500 upscale chicken coops. In addition to free shipping, if you ordered now they’d come to your property and assemble the coop — for free. This service was probably rather expensive and may have not paid out, but it evidently was worth testing. Baking money into your marketing budget for gutsy deal closers is something you definitely want to consider.

4. Set goals

Now you know what phase your business is in, your current or future sales funnels, and how much it costs to run your company. It’s time to set goals that will help you create your marketing budget.

Answering these questions is a good place to start to determine how your marketing budget and goals work together:

-

How much revenue do you need?

Everyone wants to haul in 7 or 8 figures, but the bottom line is how much money do you need to bring in to keep the lights on at your business. Factor in the operations costs from your audit as a baseline then you can add in the money you’ll need to grow your business.

-

How many sales do you need to make your revenue goal?

Naturally, this is a much more complicated equation than simply dividing the amount of your revenue goal by the cost of the product or service that you’re selling. However, it will give you a rough idea of how much you need to sell to keep your business afloat or ideally moving ahead.

-

Determine how many leads you need to convert your target number of sales.

To do that you’ll need to know what percentage of your leads (people you attract and make aware of your product) typically convert (actually purchase your product)? If you’re in the start-up phase, research typical sales conversion rates in your niche to get a realistic target. A great way to figure out the best marketing tactics for getting a high ROI on your marketing dollars is to research your competitors.

5. Study the competition

When it comes to setting a marketing budget for your small business, understanding your niche is critical. Unless you have an absolute one-of-a-kind product, you’re not selling in a vacuum. Other companies are selling to customers that could and should be yours. Consequently, you need to keep track of your top competitors and study their marketing campaigns. Not with an eye to copying them exactly, because they may be making marketing decisions on situations and considerations that are entirely different than yours. But rather to “steal” what you determine to be their best strategies and adapt them to create a marketing budget.

Here’s are some questions you need to answer:

-

Who are the major players in your industry?

Look at both the big ones and the small ones. Massive companies who sell the same kind of products that you do have the resources to do things that would be impossible for your business to do. However, you can see what they are doing conceptually — like running contests, utilizing influencers, strategically timing sales, and follow their lead on a smaller scale. Also, check out successful competitors at your company’s size level. What are they doing right that you’re not doing? Learn from all levels of competition.

-

What methods do they use for advertising?

As I said earlier, digital advertising is the main avenue for getting the word out in today’s world. But if you see your successful competitors using something else over a long period of time, it means it’s working. It also means you should consider doing it too. Are they investing in every possible marketing platform or a select few? Knowing who the leaders are and following their example is one of the easiest ways to profit from the lessons they’ve learned.

6. Develop a plan

Now that you know what your company’s financial obligations and needs are, what your sales funnel looks like, what your objectives and key results are, as well as what your competition is doing, it’s time to put together a strategic marketing plan.

Choose your tactics based on where your customer is in your funnel.

- Top. An effective marketing plan targets prospects at all stages of your sales funnel. Some tactics, like digital and traditional advertising, public relations, and direct marketing, are great for reaching cold prospects.

- Middle. These are warm prospects — people you’ve already reached with your marketing message online, in-store or in-person — will respond well to permission-based email, loyalty programs, and customer appreciation events.

- Bottom. This is where your hottest prospects are. There are people who’ve been exposed to your sales and marketing messages and are ready to buy. And don’t forget, if your product isn’t a one-time purchase like a swimming pool, they are also customers who have just recently bought something from you. In general, a sales contact (whether in person, by phone, or email) often combined with an offer adds the final push necessary to close the sale.

7. Set your marketing budget

Now for the moment of truth. Setting the dollar amount you’re going to devote to growing your business through marketing. Generally, that means allocating a certain percentage of projected gross sales to your annual marketing budget.

Naturally, if you’re just starting a business, this may mean using newly acquired funding from investors, borrowing money, or self-financing. However you pay for it, marketing is absolutely essential to the success of your business. Fortunately, because there are so many different kinds of tactics available — from free social media to paid digital ads, there’s a mix to fit even the tightest budget.

In order to create an actional marketing budget — one that really works — is to break down your marketing efforts by quarter, by month, or even by weekly. You may need to front-load your budget to cover big annual expenses like yearly subscriptions or license renewals.

Let’s do the numbers

Depending on your plan, you may need to break down your marketing budget into various digital marketing, content marketing, channel marketing, website, event, and other sub-budgets within your overall budget.

To get you started, here is a selection of 12 free marketing budget spreadsheets that will give you an easy roadmap for organizing your expenses

If after you’ve put together a plan you find out that deploying all your preferred tactics puts you over budget go back and tweak it. The most important thing is to never stop marketing. If you can’t afford the more expensive tactics now wait until your less expensive tactics start paying off — and then step on the gas later.

Make your marketing budget go further with up to 3% unlimited cashback.

The average small business has 5 credit cards with a balance of about $32k that they have to keep track of. There’s a better way than rotating through dozens of low-limit credit cards to get the funding you need to scale when you can get it all with AdCard — the best card for Facebook ads with the high limits and more you need to grow your business.

Exclusive Cardholder Benefits

- Highest Limit for Ad Spend — Guaranteed. Forget dinging your FICO score to get a higher limit. AdCard gives you all the ad spend funding you need to grow your business without hurting your ability to secure future funding from other sources.

- Account Ban Protection — Unlimited virtual debit and charge cards for ads so you can scale to the moon without the fear of getting banned. It lets you use a card with a unique number, name, and address for each ad account, business manager, campaign, and network. Also eliminates the expense of cumbersome employee cards.

- 7.5% — Highest Cash Back Card Available. AdCard gives you up to 7.5% on your Facebook ad spend when you refer a friend each month.