Congrats on starting a new company! You’re probably focused on doing a lot of things other than working to establish business credit, get business credit and build business credit, but it’s definitely something you don’t want to overlook.

Figuring out how to access business financing and credit is a common goal for both new and existing small business owners. From startup costs to new expansion strategies, establishing a strong business credit profile with diverse accounts early on can help make your immediate and future business plans a success.

What is Business Credit?

In a nutshell, business credit is the ability of your company to qualify for financing. Whether you’re a sole proprietor, an LLC, or an INC, businesses have credit reports and scores just like individuals do. Credit bureaus Dun & Bradstreet, Experian, and Equifax all keep a record of debt payments and other credit information on your business.

Information on your business credit report can be accessed by creditors, lenders, vendors, insurance companies, potential partners, and others to determine your business’s financial health when it comes to making a decision on whether they want to work with you.

So you want to make sure you do everything you can to create a favorable business credit report. Here are a few things you can do to establish business credit and then build on it to create a strong business credit profile that can help you achieve your goals.

Why You Need to Know How to Establish Business Credit

The bottom line is that a strong business credit score can help you get lower interest rates on loans, help you avoid having to pay upfront for a product or service that your business needs, and put you in a stronger position to negotiate better trade terms with important suppliers in your industry. Knowing how to establish business credit and taking steps to secure it will help you save money, keep cash flow liquid, and access the funds or assets you need to help your business grow. Not knowing how to establish business credit -- or failing to take the steps you need to take -- can limit your ability to secure financing at favorable rates.

The fact is, one of the biggest reasons business owners are denied funding is because they don’t understand how business credit works. Nav’s Small Business American Dream Gap Report found that nearly one in four businesses don’t know why their loan applications are denied, while businesses that understand their business credit scores are 41% more likely to get approved for a small business loan.

The Downside of Not Knowing about Business Credit Can Be Devastating

There are two words that should stop any business owner in his tracks when it comes to business financing and credit: Personal. Guarantee.

A personal guarantee is a promise from a business owner that they -- not their company -- are responsible for their business’s debt if the business can’t pay what’s owed. The scary truth is that 86% of businesses use their owners’ personal credit to fund their entrepreneurial dreams -- which can also create personal financial nightmares. Establishing business credit can help you draw a clear and important line between your personal and business finances and eliminate the need to sign a personal guarantee for business credit.

Now that you know how important it is to have good business credit that’s separate from your personal finances is, let’s take a look at how to build it and keep your credit scores high.

How to Establish Business Credit in 12 Easy Steps

Good business credit doesn’t happen by chance. To build a profile and a history that will position your company to be able to access cash for growth (at a favorable interest rate) you need to make some basic logistical and financial moves.

1. Make Your Business Look Legit.

In today’s world of virtual and remote business setups, anyone can launch a business from their bedroom. But you don’t want it to look that way. You can’t effectively establish credit until you’ve established your business as a legitimate enterprise. So he’s a few things that can help.

2. Create and Maintain Good Credit Relationships.

Developing a solid line of credit with industry-relevant vendors or suppliers is essential. Without it, they may require you to pay upfront for the goods and services you need to run your business. Getting a line of credit from them or arrange for net-60 days or net-90 days for payment with 3 to 5 vendors who report your payments to business credit reporting agencies, will go a long way to helping you establish a solid business credit history. Not all vendors report payments to credit bureaus (they’re not legally required to) so it pays to open accounts with ones who do.

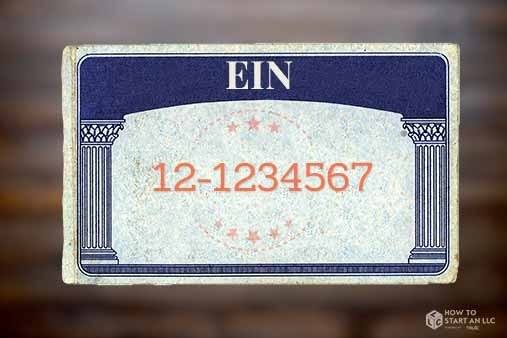

3. Get an EIN (Employer Identification Number.

A Federal Tax Identification Number, or EIN, is like a Social Security number for your business. Applying for an EIN is pretty straight forward You’ll need an IRS EIN to register your business as a corporation. You may also need one to open a bank account under your business’s name or sign business contracts.

4. Pay on time EVERY time.

Literally, nothing’s more important. Faithfully paying your bills on time shows that you can be depended on to effectively manage (and pay off) your debt. Nothing will tank your business credit profile faster than a history of late payments -- especially if they are seriously delinquent.

5. Apply for Business Credit.

There are several basic types of business credit you can get as a newly formed company or existing business with little to no credit identity established.

6. Choose the right credit card for your business.

Deciding which business credit card is best depends on where your business is in its life cycle and whether you want to earn points and travel rewards or get cash back. Interest rates and annual fees are additional considerations. Here’s a selection of card options to explore.

7. Don’t open too many credit card accounts.

Having a wallet full of credit cards might make you feel rich but it could actually make your business poorer. Opening too many accounts within a short period of time will always bring down your business credit scores because it shortens your average account age by negatively impacting your older accounts. In addition, the flurry of inquiries that will be made to open new accounts can also ding your credit score. Resist the temptation, and only get a few.

8. Actually USE your credit.

Hard to believe, but some new owners get business credit cards but don’t them. Even if you’re rolling in dough this is a big mistake because you need a credit history in order to build up your credit score. For the first six months, you need at least one active account. You also need to have at least one transaction per month on that account to be reported to the business credit reporting agencies.

This is is to make sure that the credit rating for your business shows that you pay on time on a monthly basis.

In order to make sure that at least one of your payments is reported to the bureau, you should automate one of the bills you pay monthly via credit card from your phone. This, combined with using your business credit card to pay for something at least once a month, will improve your score over time.

9. Incorporate Your Business

Separating your business finances from your personal finances is an essential step. If you haven’t already, seriously consider getting incorporated or becoming an LLC. By taking the required measures to add Inc. or LLC to your business name, you’ll be legally separating your business and personal credit profile and assets. If you don’t and simply operate as a sole proprietor, your business and personal credit history -- as well as other things -- will be legally treated as one and the same. If your business goes south or your business gets sued, your personal assets -- including your home and savings -- might be at risk.

10. Put a Wall Between Your Business and Personal Expenses

Aside from liability issues, keeping your personal and business finances has other important financial implications. By opening credit cards, lines of credit, and bank accounts in your business’s legal name, you’ll be separating your business and personal expenses. Once you do that, make sure to only spend money from your business checking account rather than your personal when it comes to business expenses. Keeping them separate also makes it a lot easier to manage taxes.

11. Keep an Eye on Your Credit Report

As incredible as it seems, a full 25% of small business owners have reported that they have found significant discrepancies in their credit reports. Taking time to monitor your business credit history can help you spot any issues and flag any information that isn’t accurate. If you do find an error, immediately file a dispute with the reporting agency. Otherwise, you might be in for an unpleasant surprise when you find you’ve been unjustly denied credit in the future.

12. Don’t Close Your Old Credit Card Accounts. it’s counter-intuitive, but If you cancel your old credit cards, you risk inadvertently lowering your business credit score. That’s because you may be eliminating old cards that have a good credit history. If you get rid of them, you automatically wipe out the good years of credit that contributed to your current good business credit score.

To avoid losing that good score that you earned with your history of on-time payments, you should keep them open. Even if you pay off a credit card, resist the urge to close it because it could hurt your business credit score.

Great Start! Now Learn How to BUILD Business Credit

Okay, so you’ve established your business and are laying the foundation for building your business credit. you have established business credit, your next step is to build strong business credit. Many of the steps laid out above will help you do that, but it’s just the beginning.

Here are three specific steps to help you build your commercial credit history.

1. Pay bills EARLY. Paying on time is essential but with some business credit scores, you can earn “extra credit” for paying your bills before they are due. Payment information on your business credit report is often more detailed than on your personal credit report. Pay faster if you can, and you may build your business credit score more quickly.

2. Make your accounts rare reporting to all the business credit agencies. Remember, not all vendors and creditors report to all commercial credit agencies. For example, your business credit card issuer may report to SBFE but not to Dun & Bradstreet. You won’t know unless you check your credit reports and scores with more than one major credit reporting agency to find out whether your accounts are helping your scores, and if not, consider adding additional credit references.

3. Use less than 30% of your total available credit. Many creditors want to make sure you’re not hyperextended before they approve you for additional financing.

Keep an eye on your credit limit across all credit cards and stay under the 30% mark to increase your chances of getting approved for a business loan.

Stay Tuned for More Tips on How to Get and Keep the Good Business Credit your Company Deserves

There are many ways to establish and maintain good business credit, and doing it is one of the most important things you can do for your company. Staying on top of this will help your company grow and succeed in today's ever-changing economy. You don't have to go it alone though. Keep an eye out for future FunnelDash blog posts that'll explore more about how to sustain a healthy balance sheet by maintaining high levels of business credit with lenders who offer competitive rates.

The average small business has 5 credit cards with a balance of about $32k that they have to keep track of. There’s a better way than rotating through dozens of low-limit credit cards to get the funding you need to scale when you can get it all with AdCard — the best card for Facebook ads with the high limits and more you need to grow your business.

Exclusive Cardholder Benefits